We also have the Brexit situation that continues to go on forever, so we have a lot of headwinds when it comes to the British pound.

As traders got involved in the market, they took a look at the US dollar as a safety trade, as it looks like all of Europe is essentially trying to slow itself down and perhaps even lockdown the borders for various countries such as France, Germany, and possibly the Czech Republic. Ultimately, this is not a good look for the European Union, and I think that eventually works against the United Kingdom as well. Furthermore, if money goes flying into the US dollar, then it is going to work against the value of the British pound also.

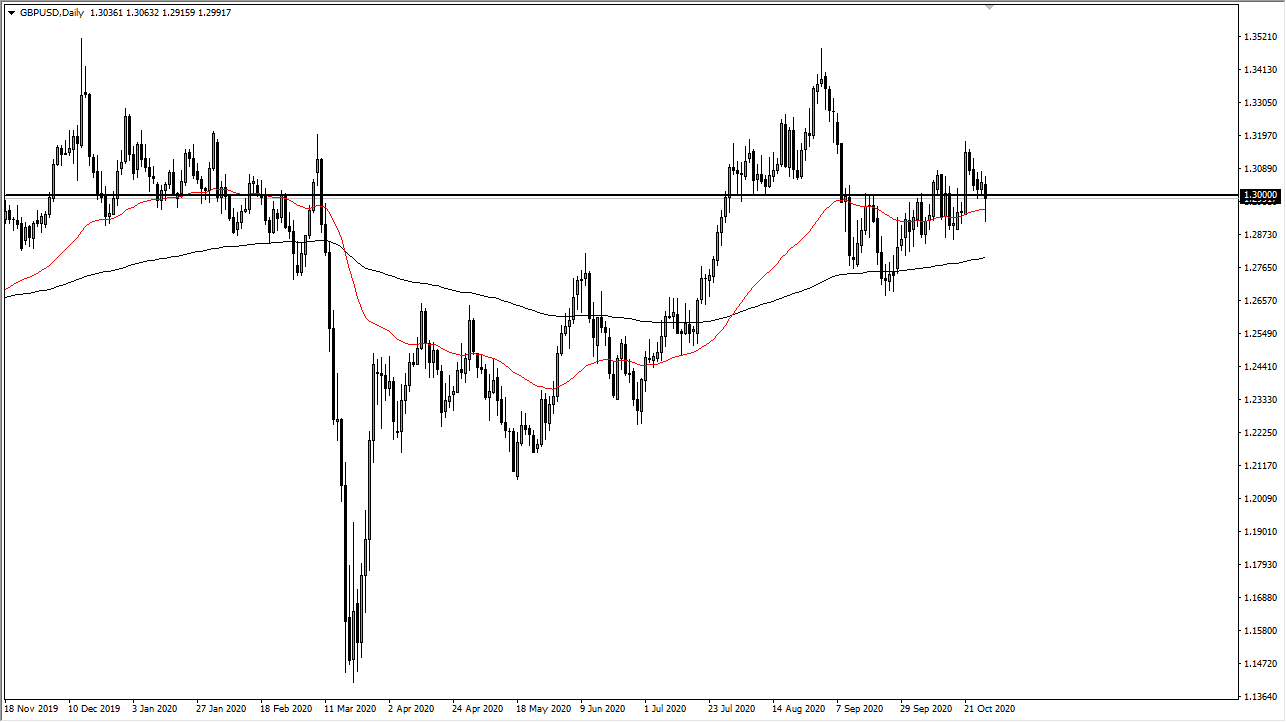

At this point though, it looks as if we are trying to build a little bit of an excuse to go higher, as we had recently broken out and now, we are retesting this area. The 1.30 level is a large, round, psychologically significant figure, and that of course will attract a lot of attention in and of itself. If we can break above the highs of the session on Wednesday, then it is likely that we could go towards the 1.32 handle, possibly the 1.34 handle after that. Ultimately, we have been in a significant uptrend for some time, so now it looks like we are going to continue to see buyers on dips as people are still banking on the idea of some type of Brexit solution that drives the British pound higher. However, in the short term it is very likely that we continue to see a lot of noise more than anything else, so it is worth paying attention to the fact that the headline risk continues to be a major issue. If we were to break down below the bottom of the hammer from the session, then it opens up a move down towards the 1.28 level, possibly the 200 day EMA. At this point time, the market continues to see a lot of upward pressure longer-term, at least until we finally decided that it is a “no deal Brexit.” At this point, there is still hope out there.