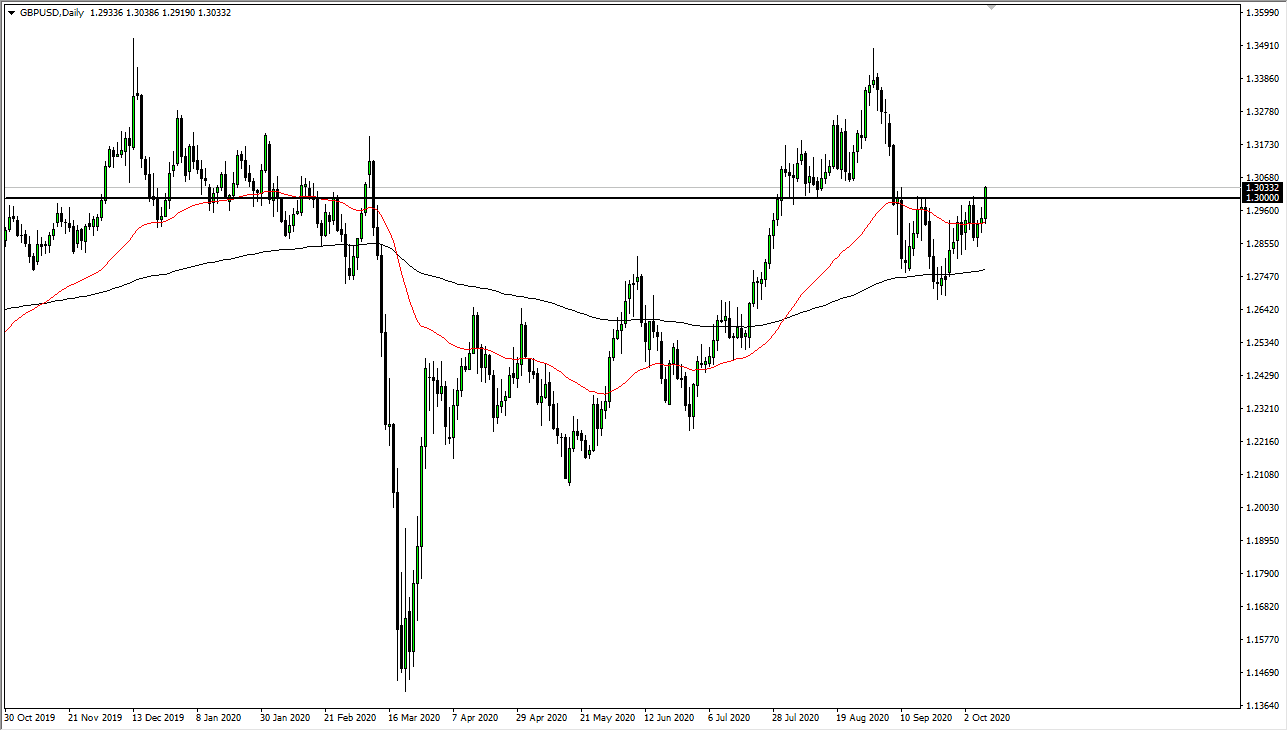

The British pound has rallied significantly during the trading session on Friday, breaking cleanly above the 1.30 level and it is now closing towards the top of the range. If we can break above that candlestick, it is likely that the market goes looking much higher. In fact, you can make an argument for an inverse head and shoulders, which is a pattern that a lot of people like. The British pound looks as if it is ready to go much higher, perhaps reaching towards the 1.34 handle above. The measured move does suggest this, but that does not mean that it will be easy.

Looking at this chart, if we do pull back I think it will be thought of as a bit of a buying opportunity based upon the idea of stimulus coming out of the United States and therefore I think we are finally seeing a market that is starting to make up its mind. Having said that, if we get some type of complete change with the Brexit, which could change things. That is the biggest problem with trading the British pound right now, as it can change at the drop of a hat. That being said, it certainly looks as if the market is ready to go higher, and therefore the market structure favors the upside, but I think the technical analysis is clear, the buyers are starting to take over again.

If and when we get that stimulus package out of the United States, the next question will be whether or not it is big enough for traders to continue to celebrate. In other words, there could be a bit of a disappointment, so that is also a possibility as well. All things being equal, it looks as if that will probably only offer a “buy the dips” type of signal. I am a bit cautious, but I recognize that longer-term we have been going higher so it is possible that if you can write out the bigger timeframe, then we can continue to go higher and make profits. I do not have any interest in shorting this market anytime soon, at least not until we break down below the 1.29 level at the very least. Currently, this is obviously more about the US dollar than it is the British pound, due to the fact that the stimulus headlines have taken everything over.