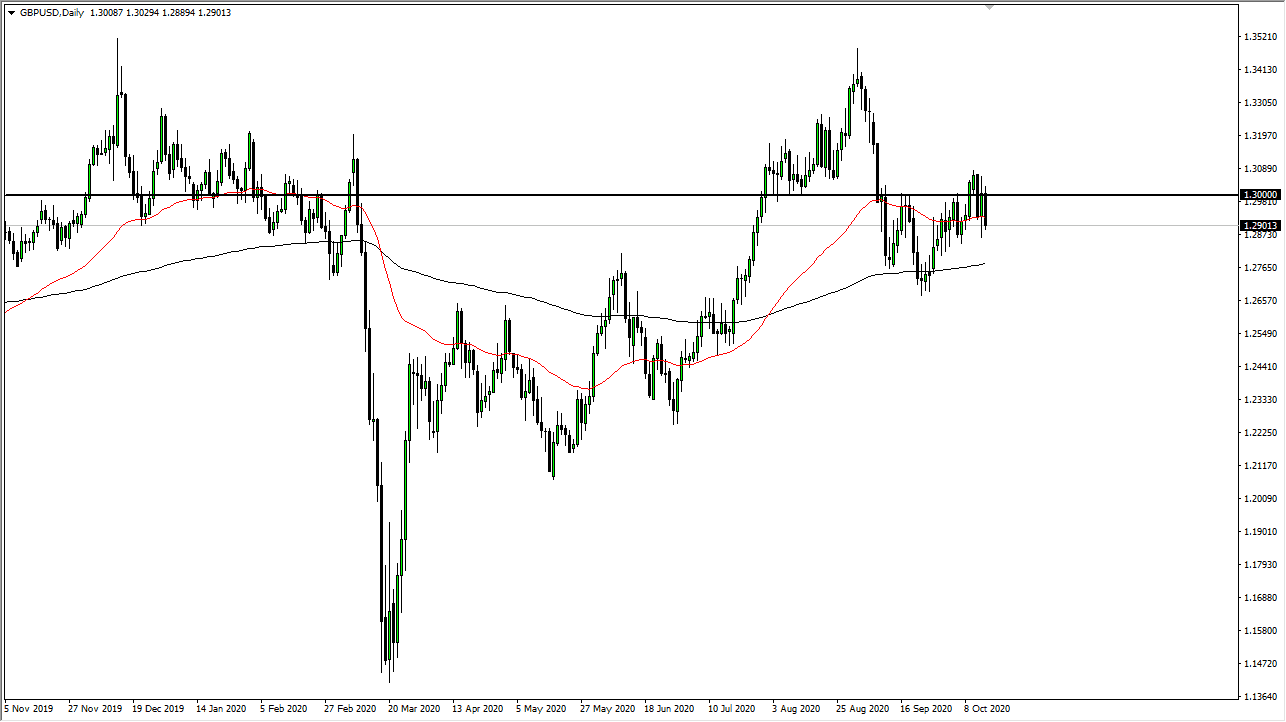

The British pound has broken down significantly during the trading session on Thursday, slicing through the 1.30 level and then the 50 day EMA. At that point, the market is now testing the bottom of the previous candlestick and is closing at the very bottom of the range. Looking at this chart, you can also see that there is a lot of support between the 50 and the 200 day EMA, which of course is quite common in longer-term charts.

Keep in mind that Brexit is going to continue to throw a monkey wrench into this situation, as the headlines and the confusion continues to be a major problem and can strike at any given moment. Ultimately, when you look at the chart you can see that we are trying to roll over but there are so many wicks underneath and the signs of support that I would be very cautious about shorting. I think that the market is going to continue to grind sideways in general, and there is absolutely no clarity at the moment.

Brexit is being negotiated still, and the deadline has been blown through. That being said, the market is likely to see a lot of random headlines that can come in and cause quite a bit of noise. Furthermore, the United States continues to discuss stimulus, and that of course works against the value of the US dollar simultaneously. It is almost impossible to trade the British pound at times, and therefore you cannot get too confident in one direction or the other. However, if we were to break down below the 200 day EMA which is closer to the 1.2750 level, it is likely that we could break down even further. Obviously, there would be something rather negative out there to make that happen, just as turning around and breaking above the 1.31 handle would send this market towards 1.34 handle based upon something very positive, again probably something to do with Brexit. Because of this, you need to keep your position size rather small, and certainly beyond your toes if you find yourself trying to trade this currency pair. For myself, I am simply waiting for more clarity to get overly excited about putting money to work. Trading the British pound might be a little easier against other currencies besides the US dollar, simply because of the stimulus equation can be taken out of the discussion.