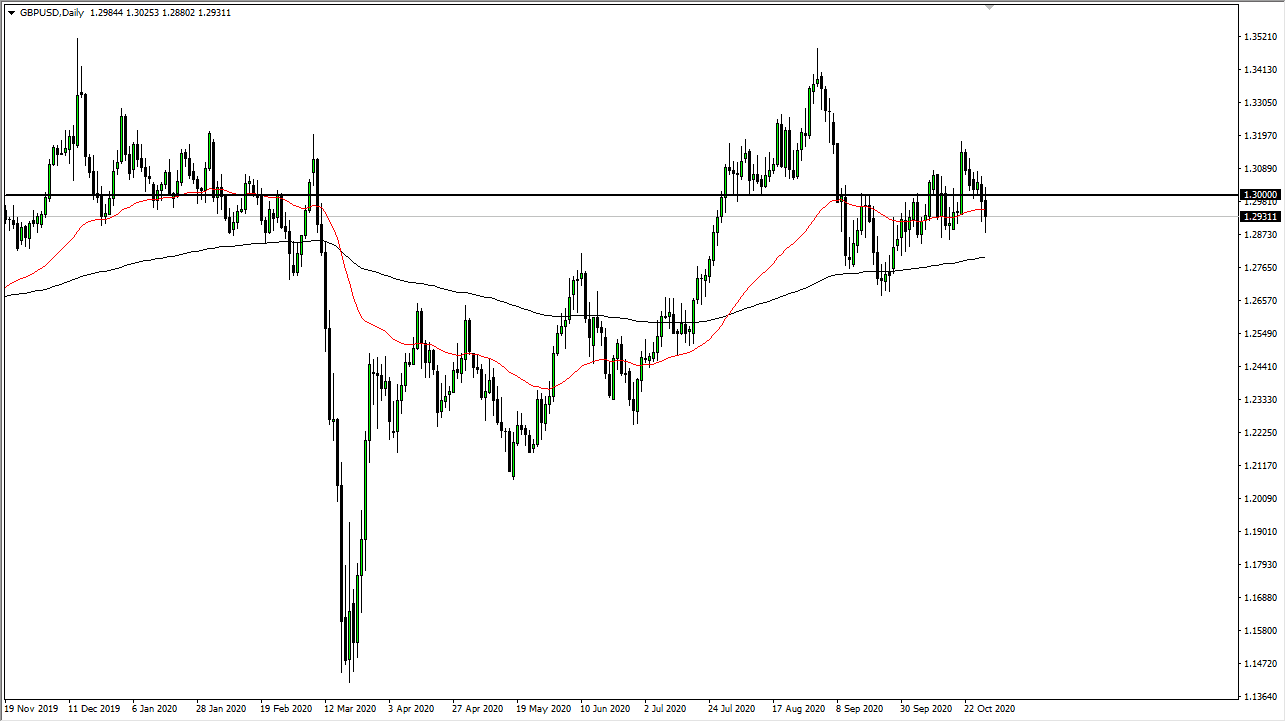

The British pound initially tried to recover the losses from the previous session on Thursday, but then found the area above the 1.30 level to be far too expensive to hang onto. We have pulled back from there, as the market then crashed through the 50 day EMA, reaching down below the 1.29 level before recovering again.

At the end of the day, we ended up forming a relatively negative candlestick, but we are starting to show support in the same general vicinity that we had seen it previously. Looking at this chart, if we break down below the bottom of the candlestick then it is likely that we go looking towards the 200 day EMA which is closer to the 1.28 handle. That is an area that we have seen a lot of buyers in the past, so it would not be surprising at all to see a break down from here offer an opportunity for buyers to get involved based upon value. That would of course be true in a normal market, but obviously this market is anything but normal right now.

As usual, we have to pay attention to the latest headlines involving Brexit, which of course will work in both directions. However, right now it seems to be more about risk appetite in the fact that the coronavirus is shutting things down in both the United Kingdom and the European Union. This favors the US dollar, plus it looks like stimulus is quite a way down the road, which of course helps the value of the greenback. Initially, people thought that the United States was going to throw a ton of stimulus out there, which would work against the value of the dollar, but that has gone by the wayside as of late. With this, I believe that the US dollar has been oversold and we will begin to see significant action in favor of the US dollar. Because of all this, I do think that it is only a matter of time before we see the British pound got crushed again, but if for some reason we see a compromise made with Brexit, it could be reason enough for this market to suddenly take off. I think we have a lot more nonsense and drama ahead of us in this pair which seems to be a never ending headache.