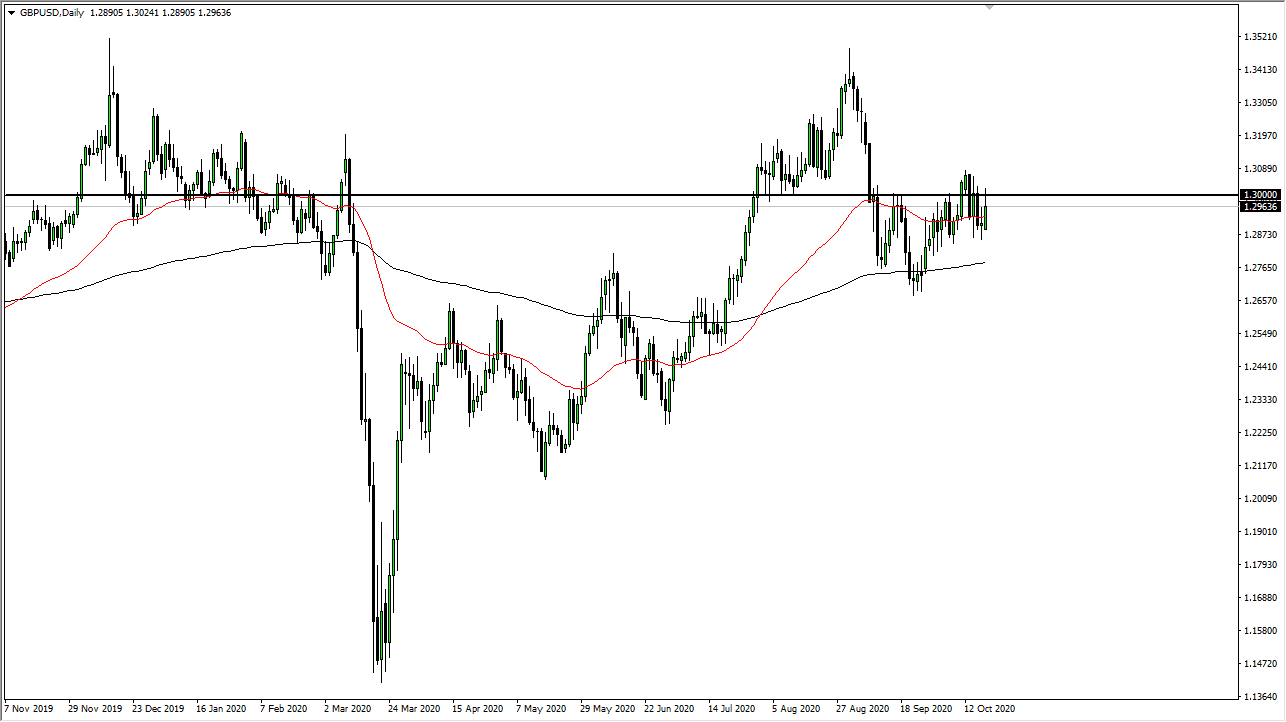

The British pound continues to struggle with the big figure of 1.30 above, where we have pulled back from. Ultimately, the market also is looking at the 50 day EMA slicing through the candlestick so it looks to me like the market is going to continue to go sideways overall which is probably the most likely of scenarios anyway, due to the fact that Brexit is still a complete mess. That being said, the 200 day EMA is sitting underneath, so that should also offer a bit of support. That support is sitting right at the 1.2750 level, an area that has been mentioned more than once by me and others as important in this pair.

The biggest problem is that any time we get a bit of a tweet or rumor or headline, this market could go ballistic. This market is one that will continue to move on raw emotion, and it is very difficult to imagine that this pair is going to act any differently. We have seen a bit of US dollar strength, but in all honesty, we have seen the US dollar pick up a bit of momentum later in the day. Looking at this chart, we are grinding back and forth, and I think we are essentially range-bound until we get some type of decision when it comes to Brexit. Quite frankly, I could have cut and paste that into the analysis multiple times over the last three years. Unfortunately, we are right back to that behavior.

On the other side of the equation, we have to ask questions as to whether or not the United States is going to have a stimulus, and if so, how much? The more the stimulus, the more likely it is that the British pound will be a beneficiary to it. Having said that, we also have to worry about whether or not the United Kingdom is going to have some type of deal when it comes to Brexit, or are they going to have a Brexit without a deal? In other words, there are so many moving pieces in this pair that are difficult to get overly excited one way or another. As things stand right now, it looks like the 1.30 area, perhaps extending to the 1.31 area, offers quite a bit of resistance.