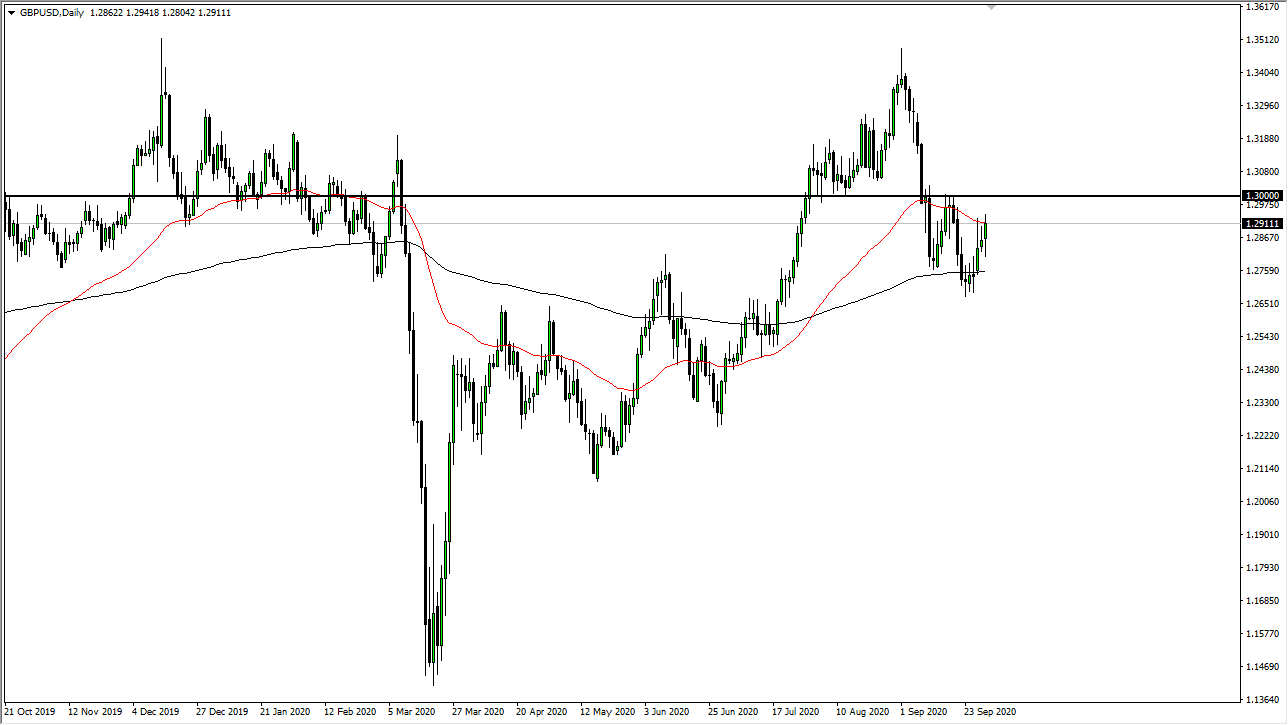

The British pound broke above the 50 day EMA during the trading session on Wednesday but gave back the gains to close underneath there. We are testing the 1.29 region as well, which is a large, round, psychologically significant figure. With all that being said, we are still very much in the down-trending channel that we had formed, and even though the British pound was very strong at one point during the session, the reality is that we still have not made a major breakout.

Keep in mind that the United Kingdom still has to worry about a whole slew of issues, not the least of which would be the coronavirus figures that are possibly going to force a bit of a locked-down, at least from a partial lockdown standpoint. The market forming this candle course shows just how volatile things are, and I believe that the 1.30 level above is going to be a hard “ceiling” in the market. If we were to break above there and close above there the daily candlestick, then you could have an argument for buying this pair as it would be a big turnaround.

Keep in mind that this pair will rise and fall with risk appetite, so pay attention to how that is going. As a general rule, stock markets rally while this pair rallies and the opposite. If the US dollar starts to pick up strength, it will hammer the British pound, as the British pound has a whole host of issues to worry about, including the coronavirus figures and Brexit which is still a major issue. Ultimately, this is a market that I think will continue to be very noisy, but I still believe in fading short-term rallies as we have seen during the trading session on Wednesday. To the downside, I believe that the 200 day EMA will probably be targeted, which is closer to the 1.2750 level. If we break down below the area around the 200 day EMA, we are likely to go looking towards 1.25 handle which is a large, round, psychologically significant figure and an area that has been important more than once. With all that being said, I believe that fading the rallies continues to work on short-term charts but be advised that sudden news headlines can cross the wires to cause all kinds of havoc.