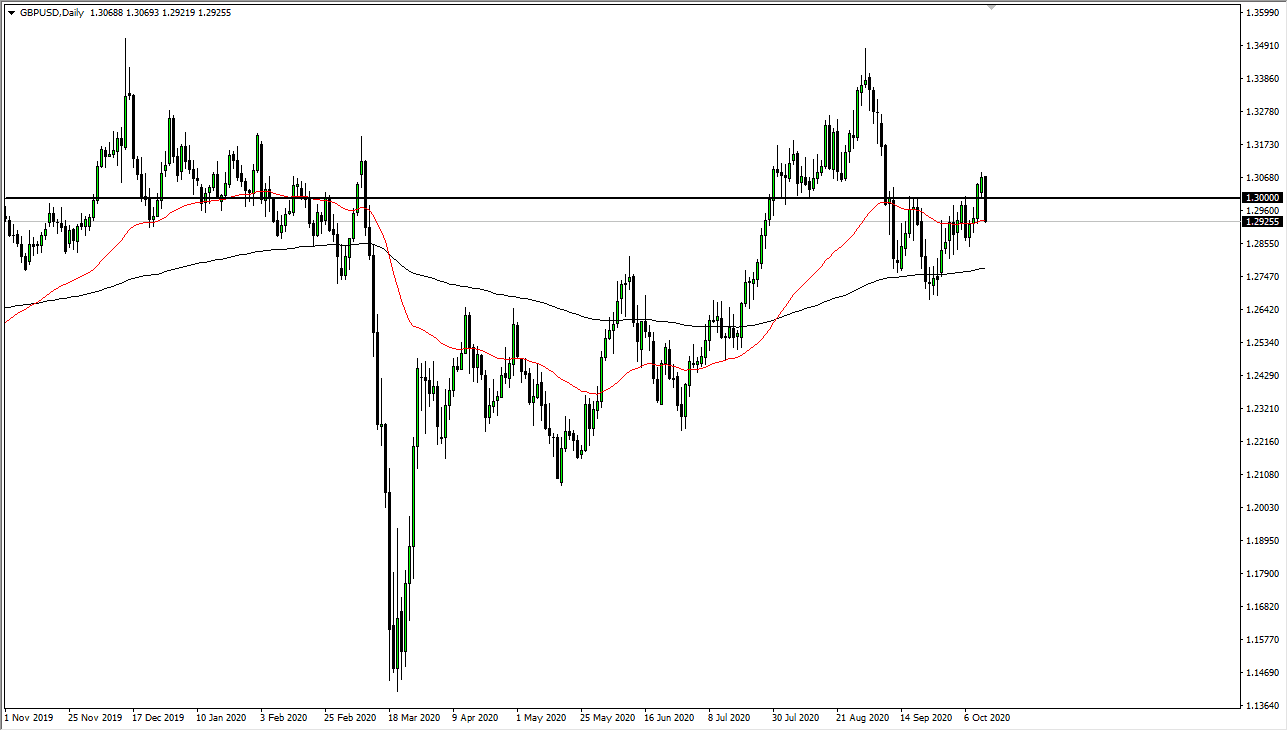

The British pound has had a tough trading session during the day on Tuesday, reaching down towards the 50 day EMA. That is an area that a lot of traders pay attention to, and as you can see it has been an indicator that has caused both support and resistance in the past. Looking at the size of the candlestick, you can see that the British pound certainly had its head kicked in for the session. However, there is a lot of noise underneath that could come into play as support and if you have been trading for more than the last couple of weeks, you recognize that at any given moment we could have Brexit cause major issues.

The size of the candlestick continues to put a bit of a negative spin on the market, but with so many wicks underneath the current pricing, it is very likely that there are a lot of buyers underneath. Furthermore, as soon as we get some type of potential for stimulus, this market will probably turn right back around. Furthermore, if we get some type of positive Brexit announcement or rumor, that could send this market right back to the upside. In other words, it is very difficult to trade the British pound in this type of environment. Quite frankly, if you wish to take the fiscal stimulus noise out of the equation coming from the United States, you can simply trade something like the British pound against the Swiss franc or perhaps even against the Japanese yen.

The 50 day EMA should have support underneath extending all the way down to the 200 day EMA, but as far as turning around and trying to figure out when to get involved, that will more than likely end up being a scenario where we will probably have to get down to the smaller time frames such as the four hours or perhaps even the hourly chart. Ultimately, this is a market that I think will continue to be very noisy, but I still think it has plenty of buyers underneath. If the market were to break down below the 200 day EMA though, that would certainly lead the British pound much lower and perhaps kill the uptrend. Until then, I anticipate that the market continues to find reasons to bounce given enough time.