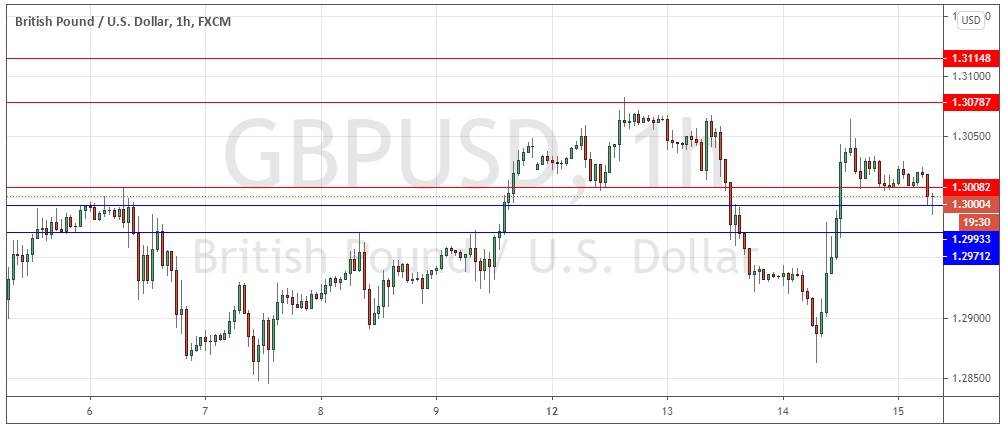

Yesterday’s signals were not triggered, as there was no bearish price action when the resistance levels at 1.2971 and 1.3008 were reached.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken prior to 5 pm London time today only.

Short Trade Ideas

- Short trade entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3008, 1.3079, or 1.3115.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long trade entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2993 or 1.2971.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that there was no long or even medium-term trend in this currency pair, so trading reversals at extremes or trading on shorter time frames along with a prevailing market sentiment from day to day was likely to be the best trading strategy.

I also thought that the price might find some short-term support at 1.2850.

This was a good call as the action was volatile, with the low of the day being made just a few pips above 1.2850.

The main driver here is clearly the last-ditch attempt which is happening right now at the E.U. Economic Summit to agree a last-minute trade deal between the E.U. and the U.K. The results will have a major impact on the U.K. economy, so rumors are pushing the price around unpredictable.

In this environment, as I said yesterday, the best option will be to trade reversals from extremes of price, while being ready to make fast exits from any trades which should be closely monitored.

The price area around 1.3000 looks very clearly like a place to avoid any new trades, it is heavily and messily disputed by buyers and sellers, which can be seen by how closely support and resistance levels are packed together in this area.

There is nothing of high importance due today regarding the GBP. Concerning the USD, there will be a release of Unemployment Claims data at 1:30 pm London time.