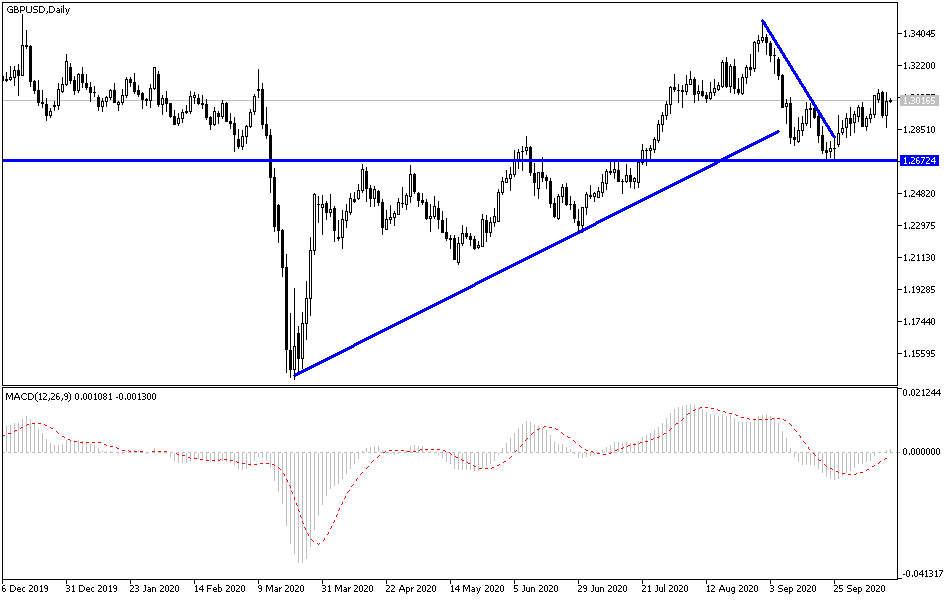

Today and tomorrow are the defining moments in the course of trade negotiations between the European Union and Britain. This is the decisive European summit that will be held, and therefore the price of the GBP/USD currency pair will be unstable until the final announcement of the summit results. Failure and the implementation of the threat from British Prime Minister Boris Johnson means a rapid collapse below the 1.2700 support at the earliest. Agreement on a postponement or a breakthrough means more gains, after which the focus will be on the consequences of the coronavirus outbreak and efforts to contain the disease. During yesterday's trading, the pair plummeted to the 1.2862 support, and quickly returned to rise again to the 1.3064 resistance, which confirms the extent of the extreme volatility that the Pound is exposed to. The currency pair is stabilizing around 1.3010 at the time of writing.

The sterling’s sudden bullish bounce against the rest of other major currencies during yesterday's trading session was supported by rising hopes that trade talks on Brexit will continue beyond the deadline imposed by the United Kingdom on itself, but recent losses leave technical indicators warning of a potential downturn to May lows. The British Pound has been volatile in recent days after coming under pressure against the vast majority of its major rivals this week, although, crucially, it is holding a partial gain against the EUR and thus may not reflect any Brexit disappointment yet that can be fulfilled before the end of the week.

Investor attention will be focused on the European Council summit today, Thursday, before which European Union leaders doubled down on their previous position that any trade deal should give fishermen automatic access to British waters and that British economic policy should continue to be guided by EU rules. The leaders of the European Union are sticking to their position but have also indicated that they will not themselves be away from the table, which leaves the ball in Prime Minister Boris Johnson's court.

Johnson has threatened several times to leave, and is expected to speak with European Commission President Ursula von der Leyen over the phone, according to the Financial Times, and sterling price action and analyst comments indicate that expectations for an extension of the talks are growing.

The price of the GBP/USD moved below the 1.30 resistance in Tuesday’s trading after failing to overcome the major resistance barrier near 1.3083, giving analysts a growing conviction in their view of the possibility of further declines. This team believes that the pound should be sold from 1.3042 and are looking to drop to 1.2450 initially, although they have a one to three-week target of reaching the 1.2250 support, which leaves the pair at its lowest level since May.

The pound weakened against the dollar when a ruling from the World Trade Organization authorized the European Union to impose tariffs on around $4 billion of imports from the United States, undermining risk appetite. Investors were already upset by Johnson & Johnson's announcement that the Coronavirus vaccine had suffered a setback in the third phase of trials. This coincided with a suggestion by Bank of England Governor Andrew Bailey that the bank still views negative interest rates as a worthwhile policy tool. In addition, the lack of Congressional support for a pre-election financial support package for families and the White House's request for congressional approval for arms sales to Taiwan may also have strengthened the dollar and undermined risk currencies such as the British pound.

According to the technical analysis of the pair: We expect a state of extreme instability for the performance of the GBP/USD pair during trading today and tomorrow until the final announcement of the European Union summit results, which will focus decisively on the future of Brexit and relations between the Union and Britain. Accordingly, we must be careful regarding trading deals on the pair for any expectations regarding the results of the summit, and it is best to wait for the final announcement. We recommend only selling from every upward level, because if there is an agreement and a postponement of negotiations, the sterling may collide with the consequences of the spread of the Coronavirus and measures to contain it. Resistance levels at 1.3080, 1.3120 and 1.3200 may be suitable for doing so. On the downside, the support at 1.2800 could be a legitimate target at first if the summit fails to meet market expectations.

There is no significant British economic data today except for what is released from the summit. On the dollar side, there will be the announcement of the weekly jobless claims and the reading of the Philadelphia Industrialist Index and the Empire State Index. Along with comments from members of the Federal Reserve throughout the day.