We have always waited for the bulls to move the GBP/USD pair towards the 1.3000 resistance for the opportunity of a stronger upward correction. It actually happened amid market optimism about the possibility of signing a trade deal between the European Union and Britain that the currency pair moved towards the 1.3006 resistance during yesterday's trading. However, the celebration didn’t last for a long time, as the sell-offs returned after double statements by US Central Bank Governor Jerome Powell and US President Trump, whose health condition improved from Coronavirus symptoms, and therefore bears pushed the pair to the 1.2866 support before settling around 1.2905 at the time of writing.

The pound recovered against the rest of major currencies on the back of headlines in which the European Union sources estimated that the last round of EU-UK talks was “one of the most positive talks so far”. The British pound has once again demonstrated its extreme sensitivity to the flow of Brexit news, with gains coming after Reuters reported on Tuesday afternoon about "significant progress" in Brexit talks, which they say makes the European Union see that the trade deal is getting closer.

According to the report, European Union diplomats said that Brussels is now preparing to negotiate until mid-November - rather than cutting off talks at the beginning of next month - to avoid the harmful "no-deal" scenario when the UK's transition period ends on December 31, 2020. While there was no breakthrough in last week's round of negotiations on the three most contentious issues - fishing rights, fair competition guarantees, and future dispute settlement methods - the prospects for a comprehensive deal looked brighter, according to the report.

"It seems that we are getting closer and closer to a deal, although public statements of not reaching an agreement may suggest otherwise," one of the two sources told Reuters, both are said to have been briefed in detail by the European Commission. Developments led to a rebound in the Pound. The GBP/EUR rose to 1.1005 from a previous low of 1.0957, and the GBP/USD pair returned to 1.3000 after being lower at 1.2920 previously. Commenting on the performance, Ned Rumpeltin, a foreign exchange strategic analyst at TD Securities, says: “From our point of view, we believe that Brexit problems will continue to be a tactical driver for the British pound’s volatility, especially in times when this is localized, like changes occurring this week for example”.

In this regard, and the extent of the vulnerability, the pound sterling declined at the beginning of yesterday's dealings, with currency traders interacting with a news report stating that the European Union will not be ready to meet the UK's easy deadline to agree on the Brexit deal by October 15. According to the Bloomberg report, the European Union is ready to contact Johnson and let the October 15 deadline pass unanswered indicating a slight rise in the odds of a "no-deal" outcome with regards to the improved sentiment witness recently on the issue.

Johnson has previously said that if the European Union and the United Kingdom fail to reach a post-Brexit trade deal by the time of the European Union Council meeting on October 15, it would be better for the UK to withdraw.

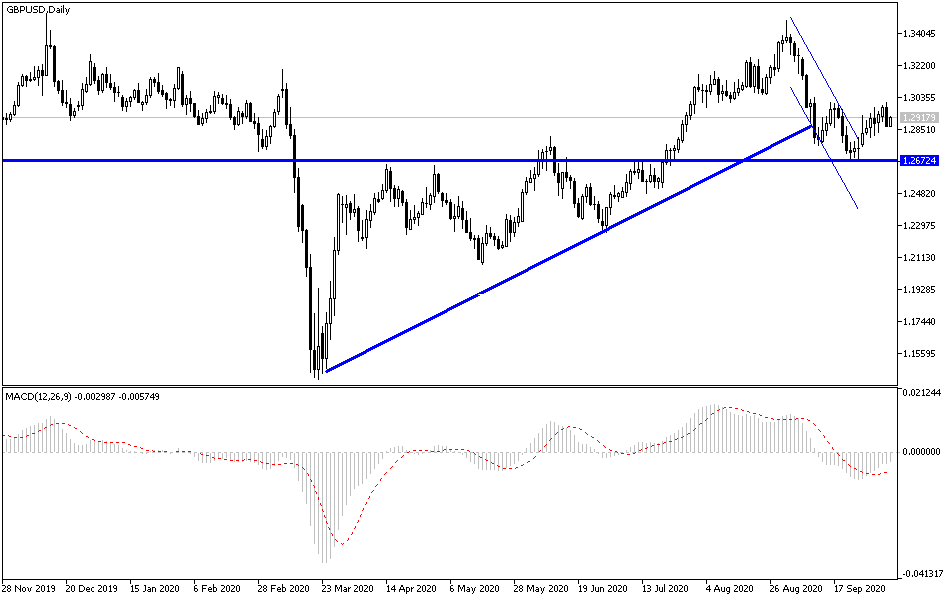

According to the technical analysis of the pair: I still believe that surpassing the 1.3000 resistance will be an important catalyst for the GBP/USD bulls to move towards better resistance levels, and the closest ones will then be at 1.3065, 1.3120 and 1.3200, and the pair may surpass that if a real breakout for negotiations and a post-Brexit deal was announced. In contrast, if this didn’t happen, the pair bears may move to lower levels, the closest of which are currently 1.2880, 1.2790, and 1.2700, respectively. Up until now, I am still selling the pair from every higher level.

Today, the pair will react to the BREXIT negotiations developments and the reaction to the announcement of the US Federal Reserve's last meeting minutes.