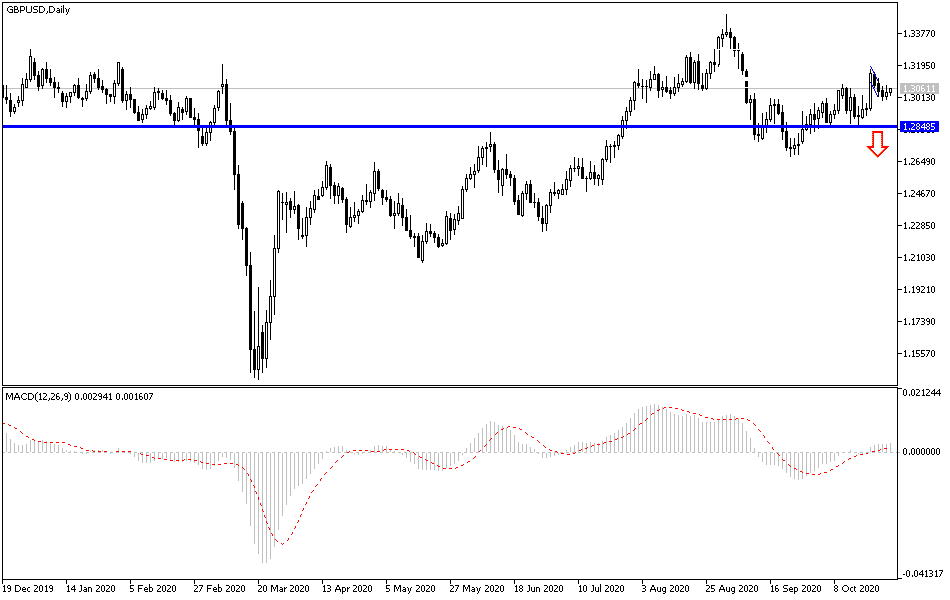

The recent state of optimism for the possibility of reaching an agreement between the European Union and Britain on the future of their relations after BREXIT helped the GBP/USD pair to some extent in facing the recent US dollar gains. The pair was negatively affected by retreating to the 1.2916 support before regaining Its strength quickly and reached the 1.3013 resistance, and then stabilized around the 1.2980 level at the time of writing. The Pound got a boost from news that the EU and UK negotiators have made progress in the ongoing phase of intense negotiations between them.

Negotiators have been engaged in talks in London since last week, and Bloomberg News reported that progress was achieved on resolving "some of the biggest disputes that have bedevilled the Brexit talks for a long time." Sources, citing Bloomberg, said the progress "strengthens hopes that an agreement can be reached by early November." It is reported that the European Union and the United Kingdom have begun to work on the text of an agreement on the level of the competitive relationship, and they are about to finalize a joint document covering state aid.

The report added that the two sides are also close to defining key aspects of how any agreement will be enforced.

Most of the expectations indicate that the British pound might achieve strong gains in the exchange market, if the European Union and the United Kingdom finally reach a trade deal after Brexit. Earlier this week, reports said that some kind of agreement might be possible by Saturday, October 31.

On the Coronavirus outbreak front, in the United States, more than 71,000 people tested positive on daily average for coronavirus symptoms, up from 51,000 two weeks ago. Cases are increasing in all states except for two, Hawaii and Delaware, and deaths are on the rise in 39 states, with an average of 805 people dying in the United States every day, up from 714 two weeks ago.

For its part, the World Health Organization said that deaths are also on the rise in Europe, rising by about 35% from the previous week. France reported 523 virus-related deaths in 24 hours on Tuesday, the highest daily number since April.

On the economic side. In the latest major report on the US economy ahead of the election date, economists predicted that US growth in the July-September quarter rose to 31% at an annual rate, according to data provider FactSet. This will follow a 31.4% decline in the April-June period - the worst quarterly drop on record - when the coronavirus outbreak shut down businesses and knocked tens of millions out of work.

According to the technical analysis of the pair, the success of the bulls in stabilizing the price of the GBP/USD, above the 1.3000 resistance, albeit temporarily, prevents further collapse and testing stronger support levels, the closest ones are currently at 1.2945, 1.2880 and 1.2790, respectively, which are levels that consolidate the strength of the bears' control on performance. This could happen quickly if the current round of negotiations between the European Union and Britain were declared to have failed. The pair will not return to the bullish correction attempt, as it happened at the beginning of last week’s trading, without moving towards the 1.3200 resistance. In general, instability will continue to characterize the sterling’s performance until the final announcement of the Brexit negotiations.

Regarding the economic calendar data: Regarding the British pound, the British money supply will be announced, followed by mortgage approvals and net lending to individuals. Regarding the US dollar, US GDP growth figures, jobless claims and then pending US home sales will be announced.