The market is likely to see plenty of buyers on dips going forward, and that makes quite a bit of sense as we see central banks around the world likely to loosen monetary policy. Ultimately, that does drive up the value of gold given enough time, because the demand for “hard assets” as fiat currency falls makes wealth preservation quite possible.

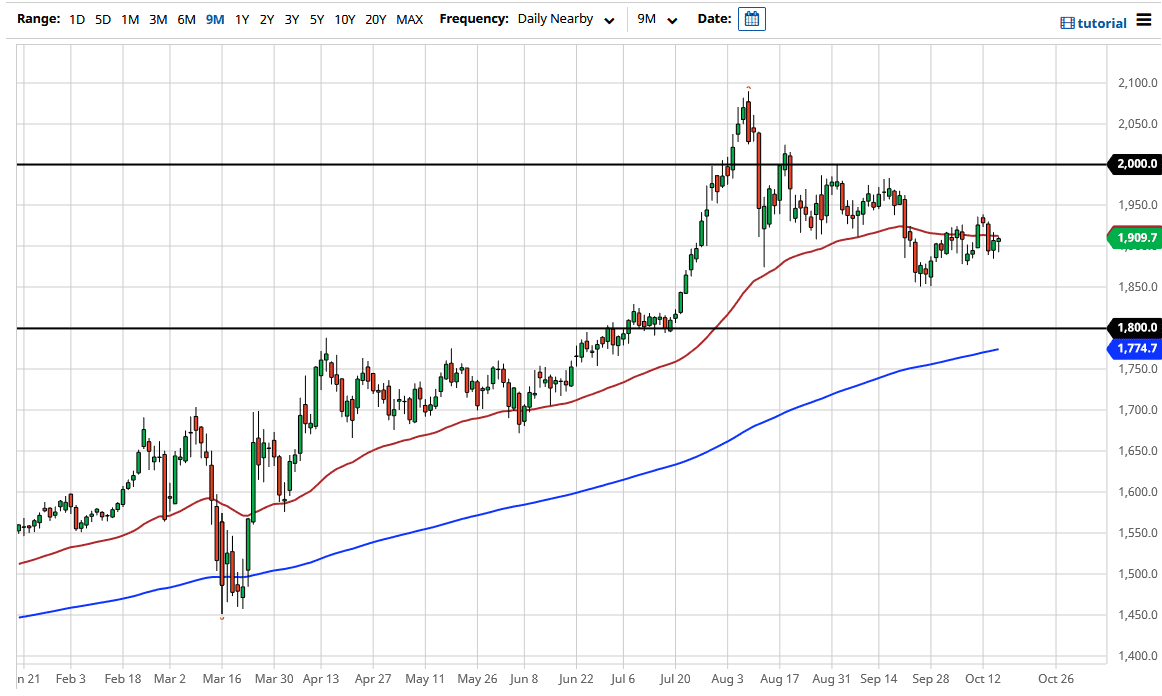

Looking at the 50 day EMA, it is sitting just above the top of the hammer during the trading session on Thursday, so if we can break above there then the market is likely to go looking towards the highs from earlier in the week. If we can break above there, then we will test the $1960 level where the market broke down significantly. At this point in time, we are starting to make “higher lows”, so that suggests that we are trying to build momentum and strength to turn things around. The market has plenty of resistance above, but it is very likely that we will eventually go looking towards the $2000 level. If we can break above the $2000 level, it is likely that we go looking towards the highs again, and then perhaps even further.

Looking at this market, I think that every time it dips you should be looking at a potential value play and try to go long. Ultimately, if we get an opportunity to build up multiple small positions for a bigger longer-term run, that is the type of trade I like here in what I think is a longer-term cyclical investment. Even if we were to break down from here, I believe that the $1850 level is rather supportive, and the $1800 level underneath there is even more supportive due to the fact that it was significant resistance previously and an area where we had a major breakout. The 200 day EMA is reaching towards the $1800 level, so that has even more support for the potential of turning around and making a bigger move. I have no interest in shorting this market anytime soon, at least not until we blow through the 200 day EMA on a daily close, something that we are nowhere near doing right now.