This is a market that I think will favor the idea of picking up value when we can, as the market has been looking at the stimulus package and driving precious metals higher. That being said, it does not necessarily mean that the market is ready to go straight up in the air, just that the gold markets continue to see a lot of noise but more than likely upward pressure.

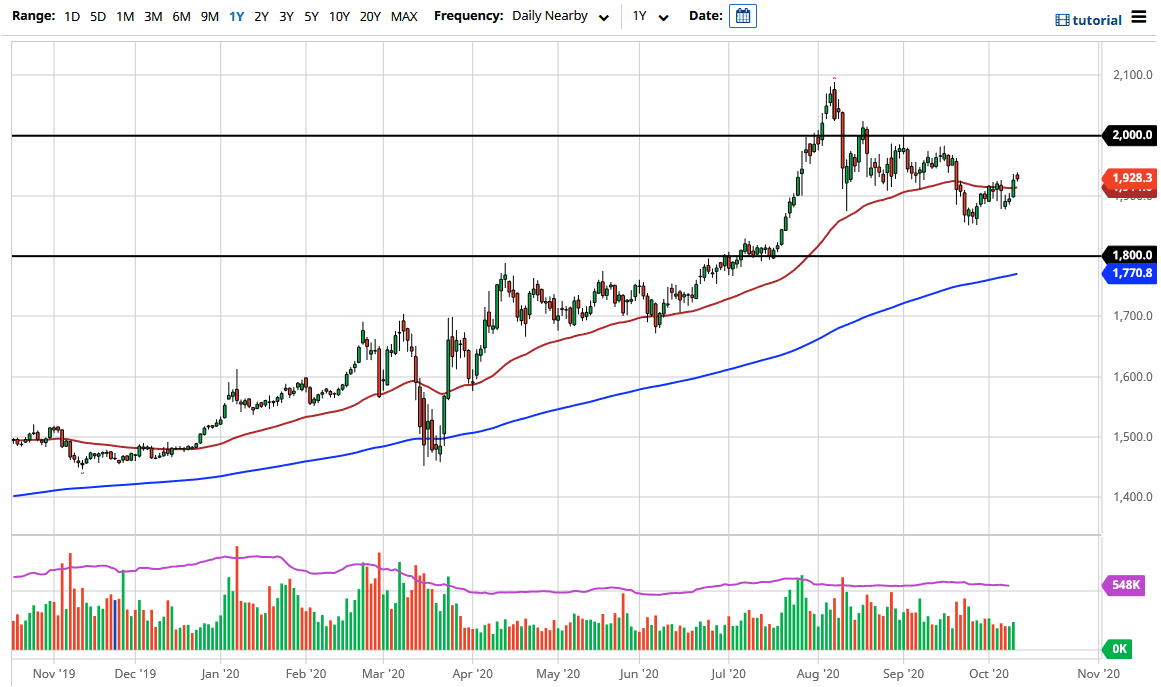

When you look at the US dollar, the negative correlation has been extraordinarily bullish for the gold markets as the greenback has given back quite a bit of the gains. That being said, the market is likely to go looking towards the $1960 level, which is where we had a lot of supply. At this point in time, I like the idea of buying dips if we get the opportunity, and I do believe that the $1900 level would be an area where we would find a lot of value hunters as well. After all, the gold markets have been in a nice uptrend and that should continue to be the case going forward. Nonetheless, I do not necessarily think that the market is one that you should just jump in with both feet and start buying.

I recognize fully that we could fall from here, but that pullback will more than likely offer value, all the way down to the $1800 level. The $1800 level is an area that has been important in the past and we had recently broken above there and now should see the market memory come into play. Ultimately, this is a market that will be moving back and forth based upon the hopes of stimulus, and of course the more likely we are to see stimulus, the more likely we are to see gold rally. Longer-term, it is very likely that the longer-term trend will continue, but timing of course is going to be crucial. Because of this, it is very likely that we are looking for short-term buying opportunities with small positions in order to build up a larger position.