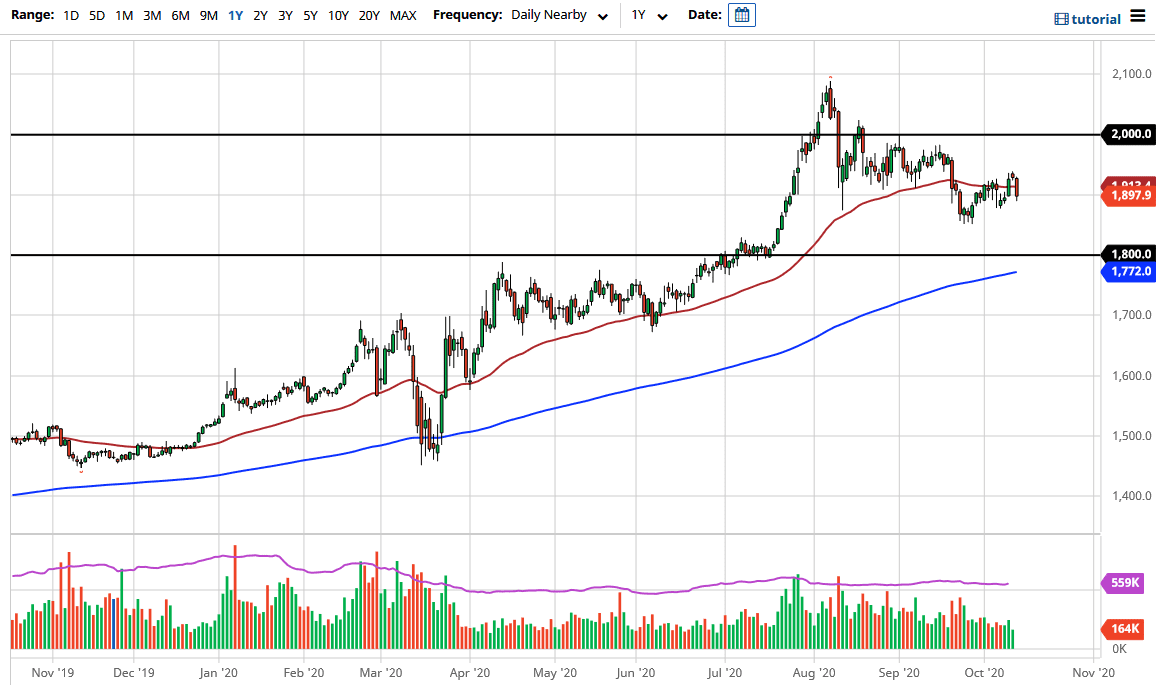

The gold markets broke down significantly during the trading session on Tuesday, slicing through the 50 day EMA. The market is breaking down below the $1900 level, which of course is an area that should be interesting for buyers to get involved. Ultimately, the market will see support there, and of course the $1850 level. That is where we had rallied significantly previously, and of course should have quite a bit of buyers involved. If we break down below that level, then it opens up the possibility of reaching down towards the $1800 level.

The $1800 level of course is an area where we have seen a lot of interest as we recently broken out from there and this was where the market produce the latest leg higher. Because of this, I think that the market will certainly have a lot of interest in demand in this region. If we were to break down below the $1800 level, then you can start to worry a little bit more about the longer-term trend.

All of that being said it is very unlikely that the market participants would be able to hang on below that area, especially as the 200 day EMA is reaching towards that region. I think that the $1800 region would be an excellent opportunity to pick up value. I do not know that we get down there, but if that is the case, I would be very aggressive. To the upside, I believe that the $1975 level would be a target where there has been a lot of supply, with quite a bit of resistance extending all the way to the $2000 handle. Breaking above there of course allows the market to go much higher, offering the possibility of a huge run higher.

Over the long term, I do believe that gold continues to get a bit of a bid due to the actions of central banks around the world and the very likely stimulus that we will see coming out of not only the United States, but various developed economies. However, the one thing that does seem to be working against the value of gold right now as the US dollar which of course had a strong session on Tuesday. As the US dollar strengthens, it does work against the value of gold, but longer-term the trend is still very much intact.