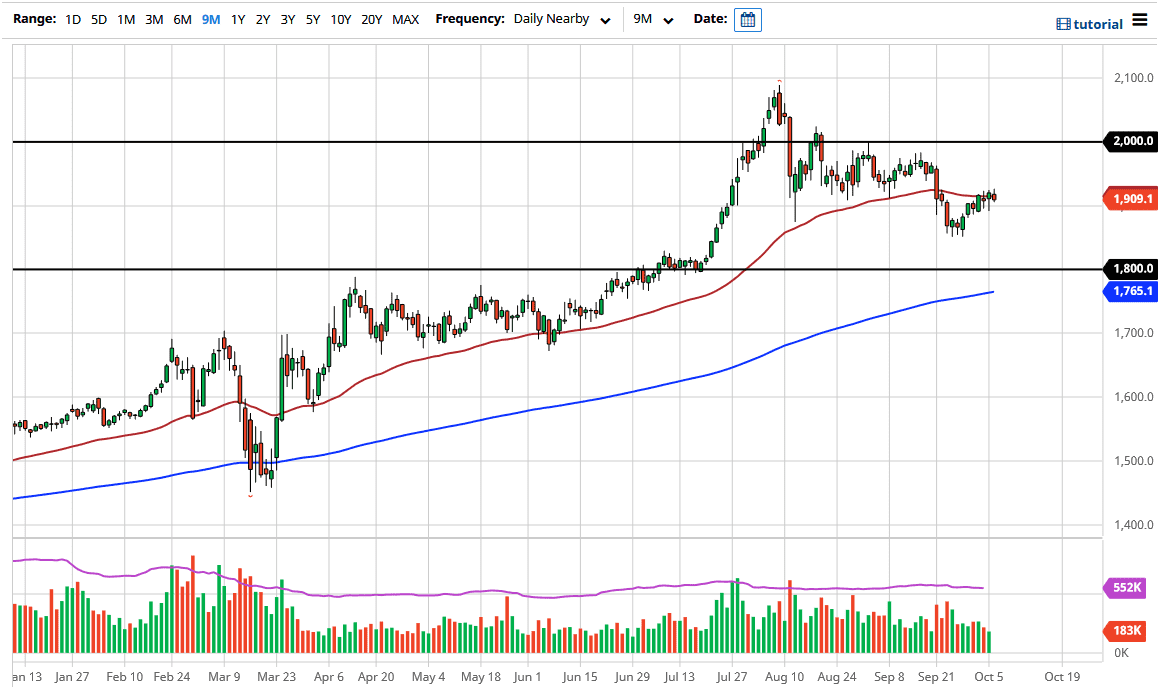

Gold markets have initially tried to rally during the trading session on Tuesday only to turn around and show negativity. The market looks as if it is ready to test $1900, which is a large, round, psychologically significant figure. That also has people thinking that perhaps the market could break down a bit further, especially considering that there is such a high negative correlation between gold and the US dollar.

By pulling back the way it has from the 50 day EMA, it shows that gold is likely to be susceptible to short-term shocks, mainly if the US dollar continues to strengthen. I think that is very possible, so at this point, it is likely that you can get gold at a better price, and that is essentially how I am looking at this. I have no interest whatsoever in shorting this market because even though I think that it falls from here, I believe in the longer-term attitude of the market, which is still going to be going higher. Therefore, I like the idea of taking advantage of the longer-term secular trend. After all, central banks around the world continue to flood the market with liquidity, and that has people looking towards hard assets such as precious metals to protect wealth. I think that is going to be the longer-term play here.

Underneath at the $1800 level, we have initially seen a market break out to the upside, and now I think it is going to be a likely area of support, due to “market memory.” The 50 day EMA underneath is starting to go to the upside, perhaps reaching towards that $1800 level rather soon. All things being equal, I think it is only a matter of time before the buyers return so I am not a seller and simply waiting for signs of support, preferably closer to the $1800 level. However, we have recently seen substantial support at the $1850 level, so that could be an area where buyers jump back in. I am looking for daily candlesticks to support the idea of going long in this market and will have to be very patient in order to take advantage of that. Gold does tend to be more of a longer-term trade, and we are clearly in an uptrend longer term.