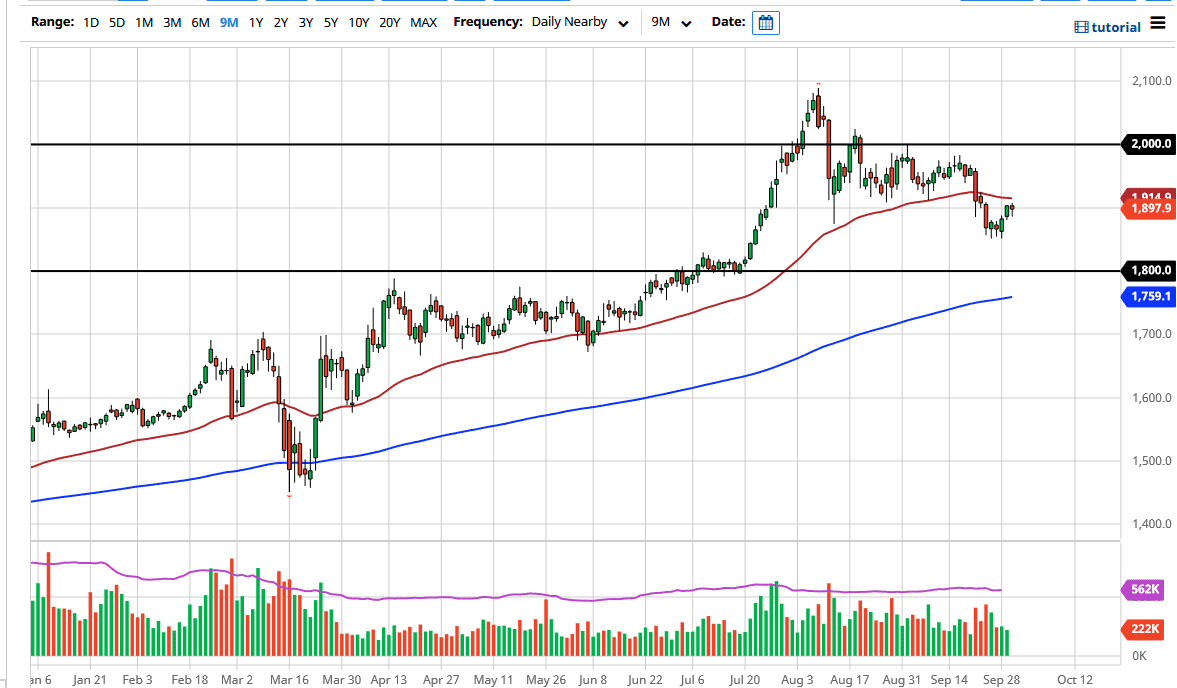

The gold market fell rather hard during the trading session on Wednesday, even as the US dollar lost a bit of strength. Ultimately, we ended up turning around to show signs of life again and form a bit of a hammer, so it does look as if the gold market is trying to build up the necessary momentum to break above the $1900 level. This is an area that has been crucial more than once, and at this point in time, I think it is likely to be broken so that we can continue to go much higher.

On the other hand, if we break down below the candlestick for the trading session on Wednesday, it is very likely that we will revisit the lows again at the $1850 level. Somewhere in that area, I think that we will find people looking to get into the market and pick up gold as it would be relatively “cheap”, but at this point, I think it is only a matter of time before we would find even more buyers to the downside. I believe that the $1800 level is the ideal long-term entry point because it was the scene of a major breakout previously, it is a large, round, psychologically significant figure.

Beyond all of that, we also have the 200 day EMA reaching towards that level, and that is an area that people will pay quite a bit of attention to from a longer-term standpoint, and technical traders to pay quite a bit of attention to that moving average. With this being the case, I think there is still a significant amount of downward pressure just waiting to happen but if we were to break above the 50 day EMA on a daily close, at that point I would have to be long of this market, as we would go looking towards the $1950 level, and then possibly even the $2000 level after that.

Pay attention to the US dollar, because if it does go much higher as far as value is concerned, that could work against the value of gold in general. This will be an especially negative sign if the US Dollar Index breaks above the 96 handle, as it would put an enormous amount of negative pressure on gold.