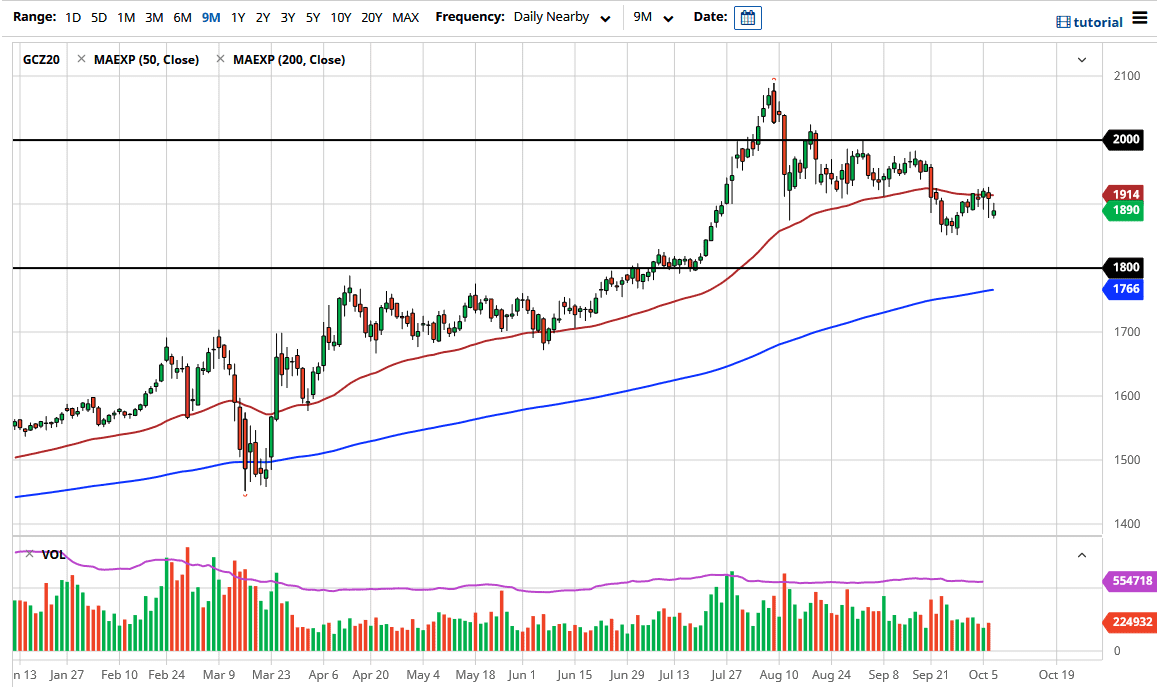

We tried to fill the gap but failed completely. The candlestick looks a bit like the inverted hammer, which of course is a negative sign as well if we break down below the bottom of it. At that point, the market is likely to go looking towards the $1850 level underneath, which is where we had seen a significant bounce from previously. Breaking down below there opens up the possibility of a move down to the $1800 level, which of course is a large, round, psychologically significant figure, and the area that we had broken out of previously to start what had been an impulsive move higher.

The 200 day EMA is starting to reach towards the $1800 level as well, so having said that it is likely that we are going to see a lot of interest in that area, and I think this lines up quite nicely for some type of “risk off” thesis. Contrary to belief, gold does not necessarily take off straight up in the air when there is a lot of risk out there, quite often it will sell off initially as the US dollar strengthens. However, given enough time both of the assets tend to go higher and value, so even if we do see a lot of fear jump into the market the initial move might actually be lower.

On the other hand, if we do break above the highs from the last couple of days which is roughly $1925, that would be a bullish and of sign to have me looking for a move towards the $1955 level where we had seen a lot of selling previously. Having said all of that, I do not have any interest in shorting gold because I believe that it is going to continue to be very strong over the longer term. Central banks around the world continue to print money and eventually that comes into play as well. Inflation is not necessarily something that anybody is seeing, but it could eventually become a problem as well. Ultimately, I believe that buying on pullbacks will probably continue to be the opportunity look for from a longer-term standpoint.