At this point, we continue to trade upon the idea of whether or not we get stimulus, and at this point it looks very unlikely that we are going to get between now and the election. If that is going to be the case, the gold markets will probably be a bit soft as the US dollar could rise.

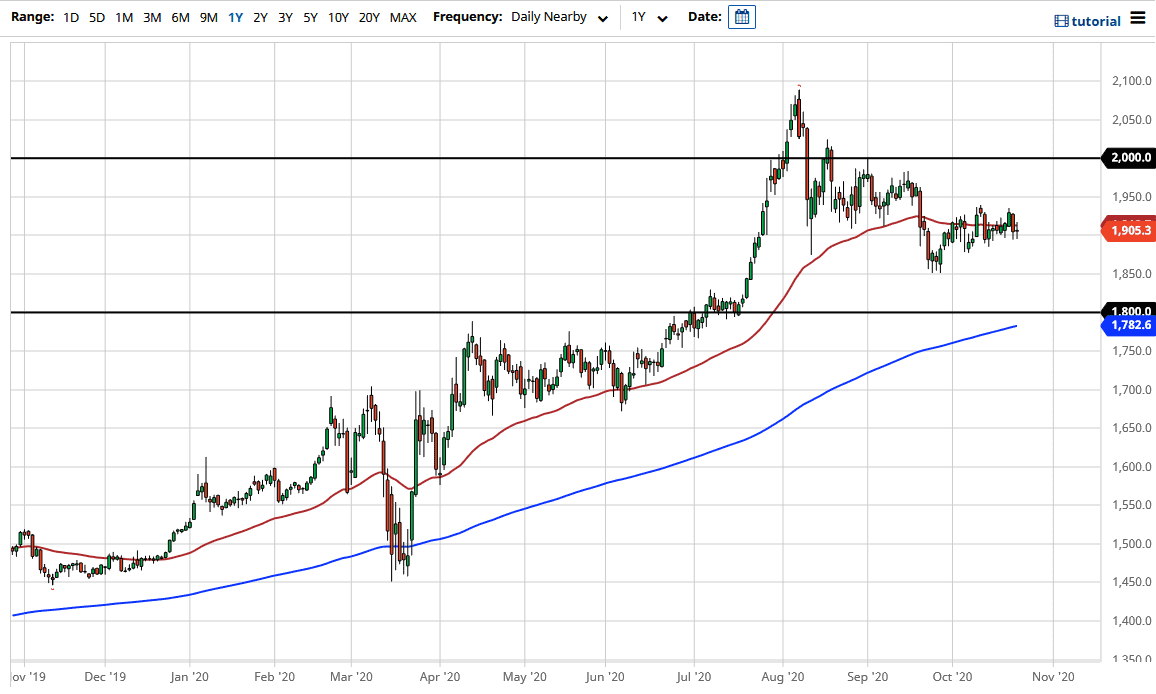

All things been equal though, this is likely a market that will eventually find buyers due to the fact that central banks around the world continue to loosen monetary policy, not just the Federal Reserve. The market breaking down from here could send this market down to the $1850 level, which is where the most recent bounce has been. If we do break down below there, then it is likely that the market will go looking towards the $1800 level underneath which is where we had broken out of previously. Beyond that, the 200 day EMA sits just underneath the $1800 level, so I think it offers a bit of a “super support level.” Because of this, buying some type of bounce in that area makes quite a bit of sense.

If we were to break down below there, then the market would open up a move down to the $1700 level. I have no interest in shorting regardless, because with central banks out there doing everything, they can loosen monetary policy, the longer-term attitude of gold should continue to be bullish. At this point time, the market looks as if it will eventually go looking towards the $2000 level, but it is going to be difficult to get up to that level without some type of fundamental catalyst. At this point time, the markets look a bit limp, so I think that a pullback makes quite a bit of sense but again, I have no interest in shorting this market because the longer-term attitude is so bullish. The candlestick for the trading session on Friday is a microcosm of what we have been seeing lately, as it is so neutral and undecided. I think that is more of what we are going to see going until we get through the election or possibly even beyond.