Currently, the gold markets are simply waiting to see whether or not the United States Congress will release stimulus into the economy, and it is literally trading based upon the latest headline or comment out of particular people on the news, and that of course causes nothing but happy. That being said, we are rapidly approaching the presidential election, which will probably be one of the angriest ones that I have ever seen. It would not be surprising at all if Congress waited until afterwards to get something actually moving, because it is difficult to give the president a victory right before the election.

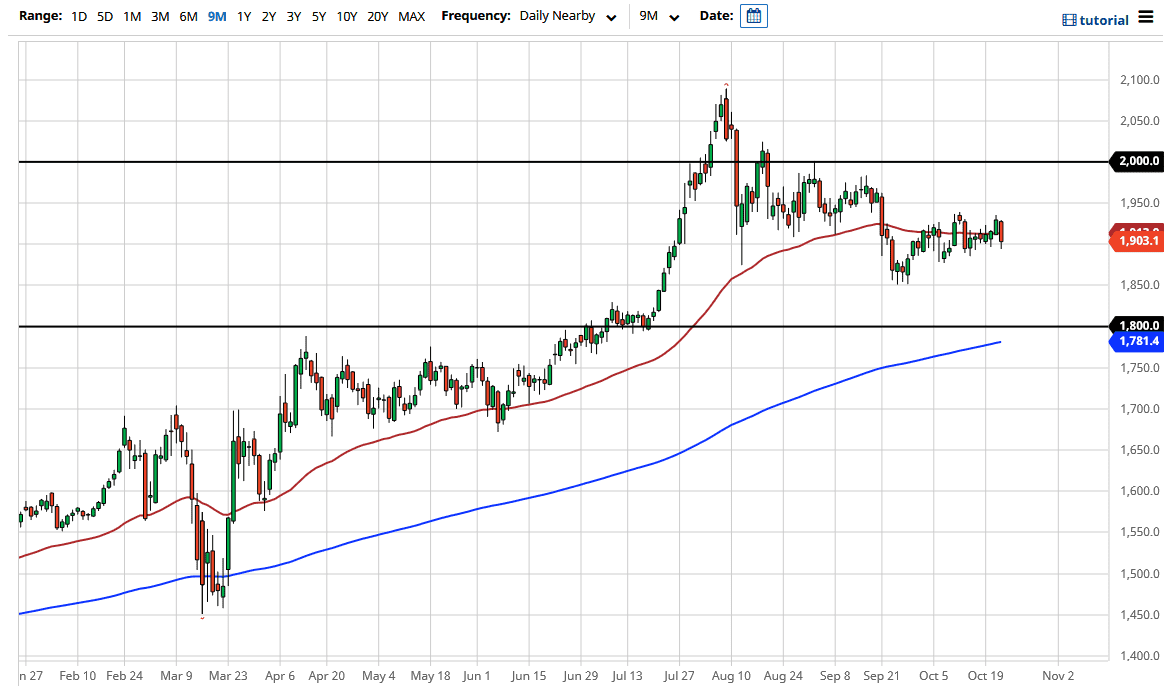

That being said, I do think that gold is an asset you want to own for the longer term. We just do not have enough momentum at this point, and I think that it is very possible that some type of shock to the system sends the US dollar higher, which could send the gold markets lower, at least in the short term. If that is the case, I believe that the $1850 level will be tested as it was before, and there is probably going to be a certain amount of support in that area. After that, we probably go looking towards $1800 which I think is the “floor in the market” that a lot of people will be paying attention to. I would be very interested in that as it was the scene of a major breakout, and of course we have the 200 day EMA currently approaching that level which of course a lot of longer-term traders will pay attention to. Ultimately, I look at pullbacks as nice buying opportunities that people can take advantage of if they are patient enough.

On the other hand, if we break above the highs of the week, we could go looking towards the $1960 level initially, and then towards the $2000 level. I do think we get there eventually but we probably have some work to do in the meantime in order to build up the necessary momentum, which may get help from stimulus but even if we do not get stimulus it is only a matter of time before we start talking about gold being bought for safety.