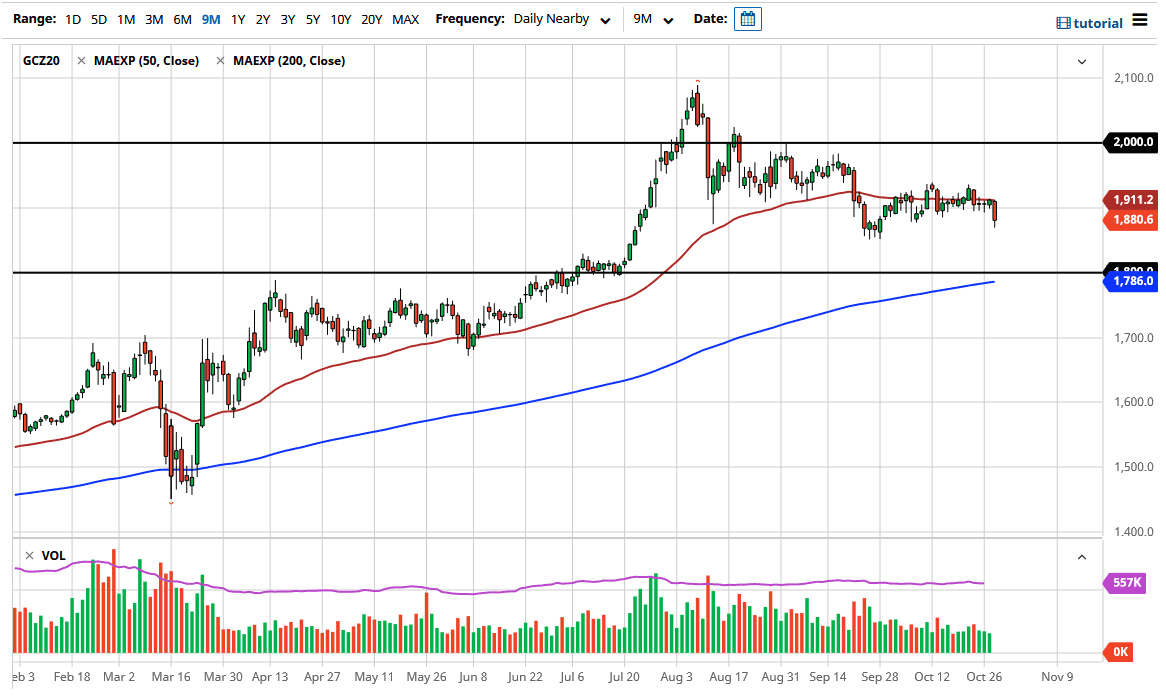

The 50 day EMA has offered a bit of a magnet for price, but at this point I think it is now going to end up being resistance, and therefore I think that rallies will be sold into rather quickly. The size of the candle is also worth paying attention to, as it is much bigger than the ones before over the last week or two, so I think we are starting to see the market really try to break out.

That does not mean that I am willing to come in and sell gold, because I think longer term fundamentals are still very good for the metal. After all, central banks around the world will continue to flood the markets with plenty of fiat, and that typically will drive up the value of hard assets such as gold, as people try to protect wealth from devaluation.

To the downside, I believe that the $1850 level will offer a significant amount of support, due to the fact that it was the scene where we had rallied from last time. If we break down below there, then the markets likely to go down towards the $1500 level, an area that I think is worth paying attention to due to the fact it is where we broke out of previously, which of course needs to be retested. Furthermore, the 200 day EMA sits just below the $1800 level as well, so that will continue to add even more support. I think it is only a matter of time before buyers jump in and pick this market up, and therefore I have no interest in shorting but I am looking for an opportunity to pick up a little bit of value if and when it shows up. In fact, I have no interest whatsoever in trying to short this market, because I think the longer-term momentum is certainly with the buyers, but I do recognize that the short-term correlation been negative between the US dollar and gold could continue to put a little bit of downward pressure in the market. All things being equal, I do think that we end up going back to the $2000 level, but we obviously have some base building to do first.