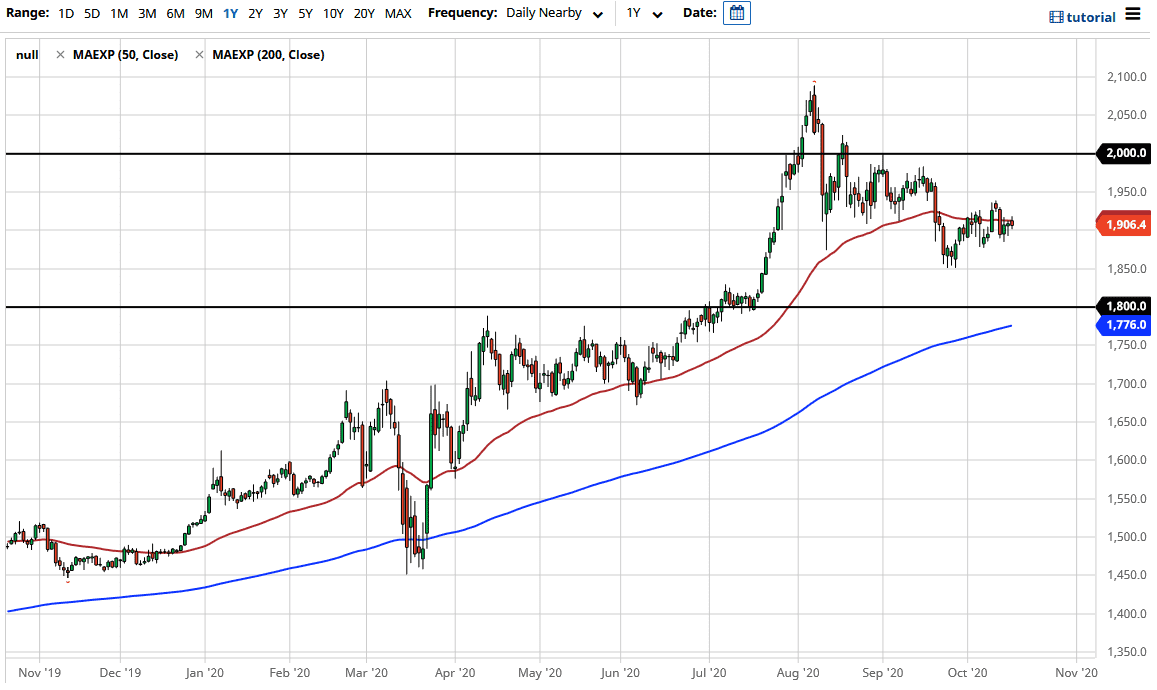

Gold markets have initially tried to rally during the trading session on Friday but gave back the gains above the 50 day EMA. The market still has shown a bit of support though, especially at the $1900 level. Ultimately, this is a market that I think continues to see a lot of sideways trading in general, and due to the fact that the 50 day EMA is so flat, we have so many different things happening at the same time that could come in and cause issues and perhaps more importantly, caution.

The market has plenty of support at multiple levels, most notably the $1875 level, the $1850 level, and then most importantly the $1800 level. All of these levels offer different varying degrees of opportunity, with the $1850 level being very important as it is where we had bounced from before. If we were to break down below there, then the $1800 level becomes even more crucial as it is the scene of a major breakout previously. This is a demand area that has not been tested recently, and even more importantly we have the 200 day EMA sitting just below the $1800 level that could also offer quite a bit of support.

Keep in mind that the market will continue to move based upon the idea of central banks around the world loosening monetary policy and keeping it that way. Furthermore, the possibility of a stimulus coming out of the United States is starting to strengthen the US dollar, thereby putting a bit of pressure on the gold market. Because of this, I think it is a matter of time before we see the gold market offer a bit of value. It is because of this that I am watching the support levels underneath and looking to pick up value as it occurs.

To the upside, the $1960 level would more than likely be an area of resistance as we have seen a lot of selling there, and then obviously the $2000 level would be as well. I do believe that it is only a matter of time before we break above there, but this is more or less a longer-term call. I think between now and the election you will have a hard time seeing any type of significant move in one direction or the other and gold markets. I think we are more or less consolidating, perhaps with the slightest of downtrends for the short term. However, longer-term this should be a nice buying opportunity.