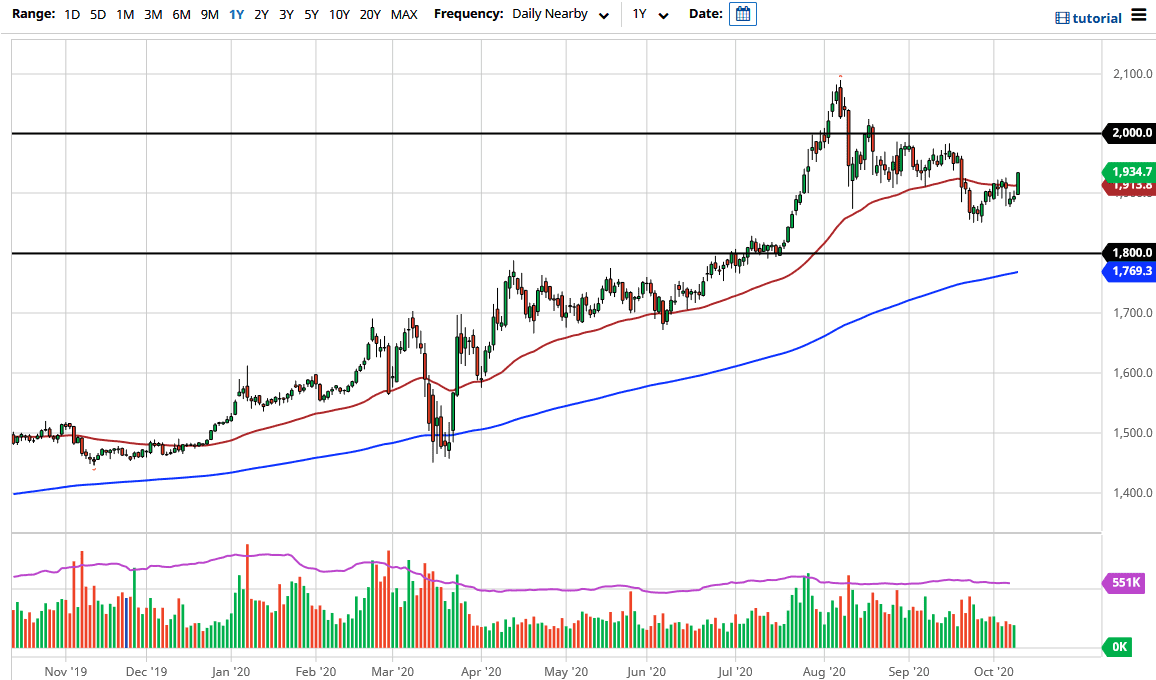

Gold markets have rallied significantly during the trading session on Friday, breaking above the 50 day EMA. Ultimately, we have broken not only above the 50 day EMA, but we have broken above the gap lower that had sent the markets down earlier in the week. This suggests that we are going to continue the longer-term uptrend, which should send this market looking towards the $2000 level given enough time.

I like the idea of buying short-term pullbacks because gold is going to continue to be bullish due to a weakening US dollar and other currencies. After all, the market is likely to see a push higher based upon stimulus and a potential “safety play.” The fact that we are closing at the top of the candlestick is a very bullish sign as well, so I like the idea of buying every time it offers “value.” If you have been following me here at Daily Forex recently, you know that I have talked about how gold could continue to fall, but I was not interested in shorting. Friday’s candlestick shows you exactly why I have been saying that.

We have not changed the overall trend, and we now are likely to go back towards the supply area at the $1965 level. All things being equal, this is a market that I think will not only reach towards the $2000 level, but then go looking towards the $2100 level after that. To the downside, I think there is a significant amount of support down at the $1850 level, and then down to the $1800 level where I think that the market is going to find plenty of “market memory” based upon the previous massive breakout. The 200 day EMA is reaching towards the $1800 level, and it is likely to continue to attract a lot of attention if and when we go down there. All things being equal, I think that this is a market that will continue to go higher based upon not only the stimulus but the fact that we are going to see central banks around the world pump the markets full of cheap money. That makes people looking for hard assets such as gold and other commodities going forward to protect wealth.