This is a market that continues to see a lot of noise in general, and that makes quite a bit of sense considering that the US dollar is all over the place. A lot of people are banking on some type of “blue wave” in the US elections, but the reality is that things are a bit more mixed up than that. With this being the case, it is likely that the market is going to be covering its bases at this point, so it is worth noting that the moving picture for the elections will continue to have people on edge.

It is also worth knowing that the markets have essentially done nothing over the last couple of weeks, as we are settling in to try to figure out where we go next. The US dollar is key to say the least, so having said that it is likely that the gold markets will continue to move back and forth based upon them. You need to pay attention to the US Dollar Index, as the precious metals markets tend to move in an extremely negative correlation to the greenback.

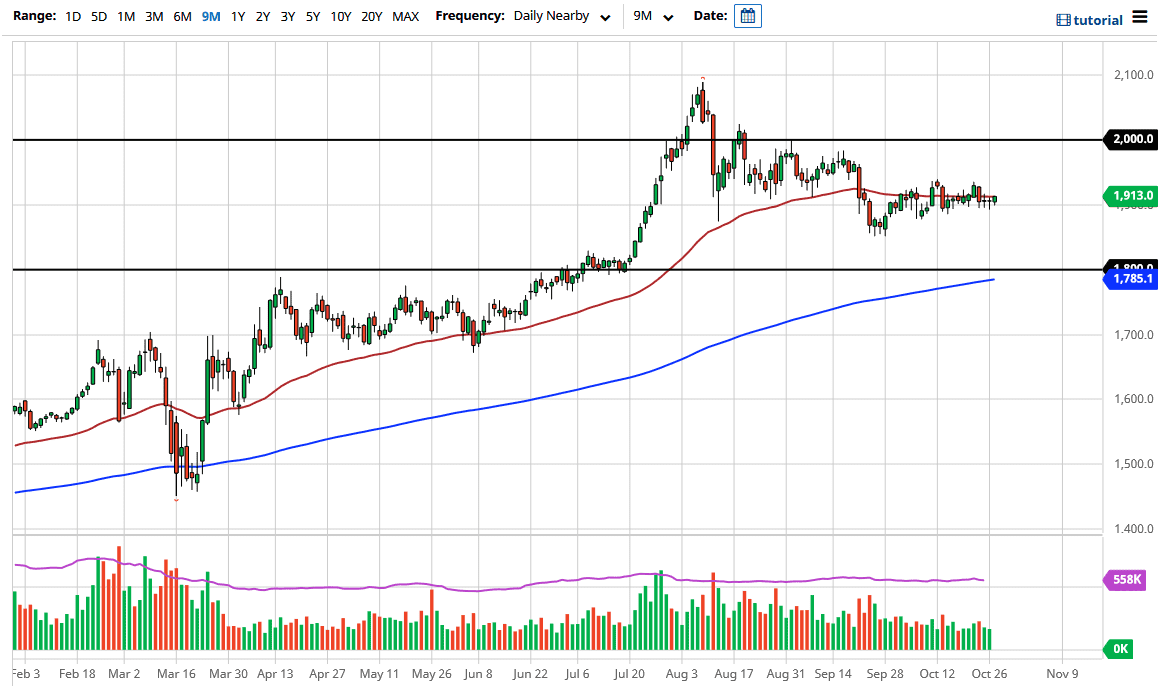

The $1900 level of course is a large, round, psychologically significant figure, and therefore it does attract a certain amount of attention in and of itself. If we break down below there, the $1850 level is crucial to pay attention to, as it was where we initially bounced from. Having said that though, the $1800 level is a large, round, psychologically significant figure as well, and the scene of the last major breakout. The 200 day EMA sits just below there, so at this point in time it would be a great area to start looking for a longer-term buying opportunity.

I would be more than willing to jump in and buy bigger positions down at that level, but I also recognize that if we break out above the $1940 level, we are likely to go another $20 higher rather quickly. Above there, then we have a massive barrier in the form of $2000. With all of this, I do prefer the downside more than anything else, but I also recognize that the longer-term is most certainly to the upside. I am still looking for some type of value.