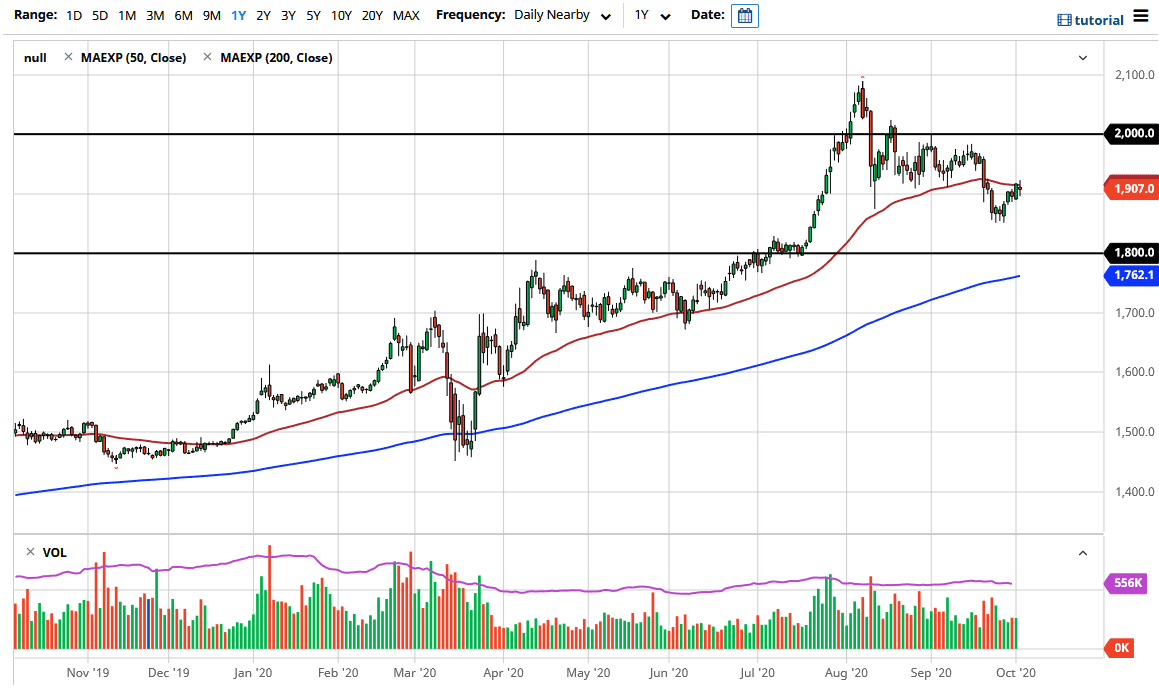

The gold markets have gone back and forth during the trading session on Friday, essentially deciding nothing at the 50 day EMA. The market has been very choppy and sideways during the bulk of the session as we have a whole plethora of reasons to think that the gold markets may pull back, not just the 50 day EMA.

While I like gold from a longer-term standpoint, I think that US dollar strength will probably continue to cause some issues, which works against the value of commodities in general. The candlestick is almost unchanged and sitting just below the psychologically important 50 day EMA. At this point in time, I think if we can break down below the bottom of the candlestick it is likely that we could go down towards the $1850 level where we had just seen a bit of a bounce. While I think that is supported from the shorter-term, I think that it is likely that we break down below there and go looking towards even more supportive action at the $1800 level.

The $1800 level was where we had seen a major breakout and it makes sense that the market would be looking at “market memory” in that area to cause a bit of a bounce. That being said, a lot of traders would be willing to jump in there, and most certainly ones that had been short of gold would be more than willing to get rid of it at roughly breakeven. The 200 day EMA is currently reaching towards that area as well, so that could cause a bit of support. Ultimately, I think that this market will continue to find value hunters and I am certainly going to be one of them. However, I do not necessarily feel the need to jump in with both feet anytime soon. Having said all of that, if we did break above the top of the candlestick for the trading session on Friday, then the market is likely to go looking towards the $1950 level. I think that it is going to take a significant and monumental change to break above the $2000 level again, although I do think that change is coming, albeit not in the short term. I am a longer-term “buy-and-hold” type of investor when it comes to gold, but I recognize that there is likely more value to be found.