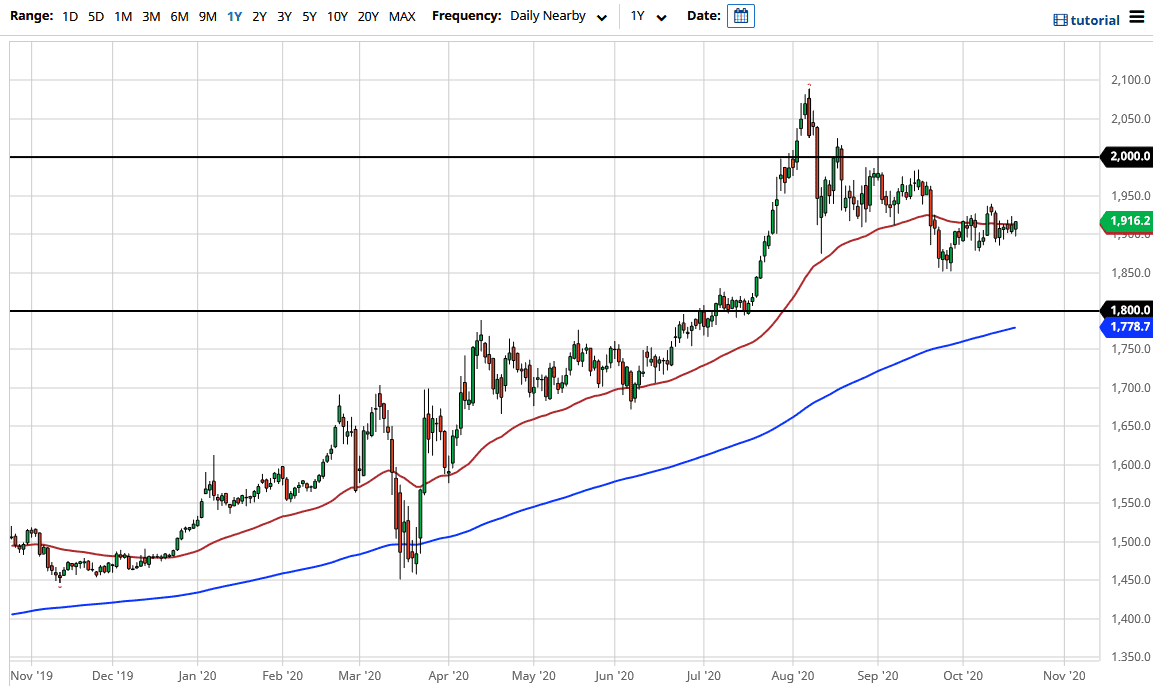

Gold markets initially pulled back just a bit during the trading session on Tuesday, to reach down towards the crucial $1900 level. That of course is a very negative sign, and it could continue to be an area that people pay attention to. Nonetheless, we did bounce from there and therefore it suggests that we still have plenty of buyers underneath. In other words, this is a market that will continue to go back and forth and try to figure out where we go going forward. After all, the US dollar continues to be sold off, but ultimately, we are going back and forth in the Forex markets. With that being the case, the market is likely to see a lot of questions when it comes to where we are going next.

If the US dollar sells off drastically due to something along the lines of stimulus, then gold should go higher if the US dollar got sold off. Furthermore, it also offers a bit of a safety trade for traders as well. Ultimately, this is a market that respects the 50 day EMA as it is flattening out, and the $1900 level was previous support, and now it looks like it is trying to reassert that. If we were to break down below the last couple of sessions, it is likely that the market goes looking towards the $1850 level. That is where we had recently bounced from, at the short term low. I think that there would be a certain amount of buying pressure there. After that, then we have the $1800 level which is a massive area that is previous resistance, and now the 200 day EMA is racing towards it. That being the case, I think that it would be a very interesting place to be buying gold.

Even if the US dollar starts to strengthen quite drastically, the reality is that the gold market could pull back initially, but longer-term I think it is only a matter of time before both would go higher. To the upside, if we can break above the $1940 level, then we will go looking towards the $1960 level, and then eventually $2000 which I think is a major fight just waiting to happen.