Gold prices settled higher at the beginning of this week’s trading, despite gains being modest, as optimism regarding the fiscal stimulus law limited the bullishness of the yellow metal. Gains reached $1933 an ounce before settling around $1923 at the time of writing. Gold price is still supported by the USD drop and increasing global concerns about the strength of the second coronavirus wave, as infections increased in many countries around the world, leading to the imposition of new restrictions and economic closure measures, which contributed to investors' appetite to buy safe havens, led by gold.

In similar performance, silver futures rose to $25,271 an ounce, while copper futures settled at $3.0640 a pound. In contrast, the Chinese yuan fell abroad after the People's Bank of China removed a requirement for banks to keep reserves from the yuan futures.

On the other hand, the President of the US House of Representatives, Nancy Pelosi, rejected the latest version of the Coronavirus relief bill from the Trump administration on Sunday, but investors still hope that US lawmakers will eventually approve a new stimulus package. The UK Prime Minister, Boris Johnson, has announced a three-tiered system of imposing additional restrictions on parts of England. Pubs and bars have been closed in areas that are set at the "very high" alert level.

As for US politics, the US presidential election provides a clear framework for the lack of fiscal policy agreement. However, does this hurt? It is not clear whether President Trump, who appeared to be proposing, wants a bigger package of the $2.2 trillion stimulus bill passed by the Democratic House of Representatives and will find support from many Republican senators. Some object to size, others to the substance. The Republican Senate has backed a $650 billion package. Even if there is an agreement at this late date, it is unlikely that the fiscal stimulus will be introduced before the US presidential election, as if this was the major game-changer factor in trends in opinion polls. It will take the best part of two weeks to draft the legislation. In March, it took about three weeks to start distributing the stimulus. Aside from the drama, Trump has arguably advanced the Republican agenda for tax cuts, deregulation, and the appointment of conservative judges. On this agenda, confirmation of a Supreme Court nominee is of greater priority. Barrett's confirmation hearings have begun, and a vote is due in two weeks.

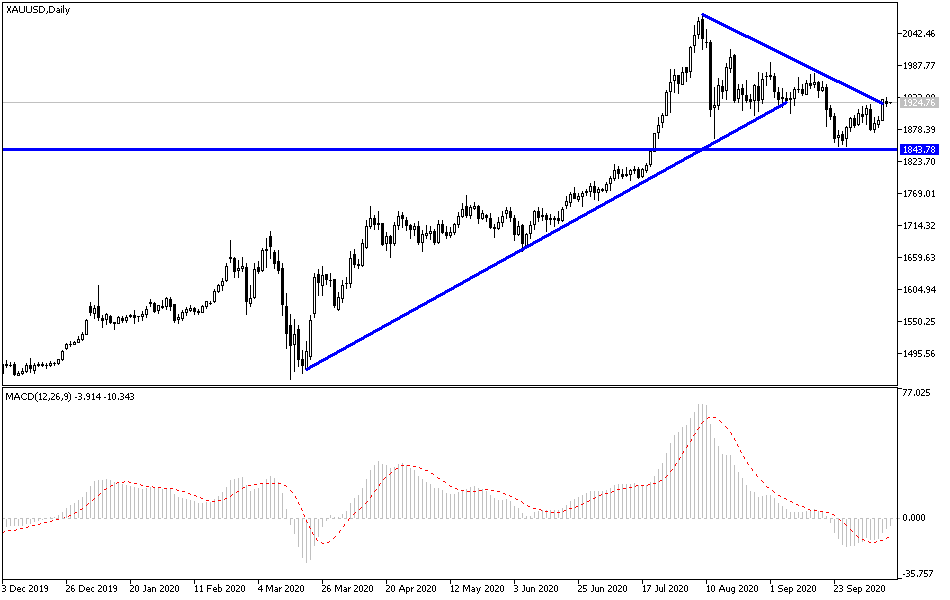

According to the technical analysis of the gold price: There is no change in my recent technical view of the gold performance, as the correction remains high as long as the price of the yellow metal is stable above the $1900 resistance, the continued decline of the US dollar and the flight of investors from risk amid global fears of the strength of the second coronavirus wave. There will be an opportunity for the yellow metal to move up towards the resistance levels at 1935, 1955, and 1970, respectively, which in turn will support the move towards the historical psychological resistance at $2000 an ounce. In return, there will be no real threat to gold's gains, according to the performance on the daily chart, except by moving towards $1889 an ounce. I still prefer to buy gold from every drop.

The yellow metal price will interact with the release of economic data results, which are: British employment numbers, the German ZEW index reading, and US inflation numbers through the consumer price index.