The pace of buying the US dollar has stopped after the announcement of Trump's health improvement from the symptoms of the Coronavirus. Therefore, the price of gold was better suited to rise towards $1919 an ounce before settling around $1910 at the time of writing. Optimism has returned to the financial markets regarding the American relief package from the Coronavirus. In contrast, growing concerns about rapidly growing new coronavirus cases in the United States and many other countries around the world have increased demand for safe-haven assets such as the yellow metal.

Silver futures ended trading higher, reaching $24,560 an ounce, while copper futures settled at $2.9630 a pound.

In general, investors are pinning their hopes that the US will pass a new stimulus bill sooner rather than later. Trump tweeted over the weekend that the United States "wants and needs stimulation." For her part, House Speaker Nancy Pelosi told CBS in an interview that progress is being made on coronavirus relief legislation to respond to the economic fallout from COVID-19.

Separately, Politico reported that Treasury Secretary Stephen Mnuchin and Pelosi had consulted Fed Chairman Jerome Powell on stimulus talks.

In terms of economic news, activity in the US services sector unexpectedly grew at a faster rate during the month of September, and accordingly, the ISM said that the services PMI rose to a reading of 57.8 in September from a reading of 56.9 in August, and according to the index, any reading above the 50 level Indicates growth in the service sector. Economists had expected the index to decline to a reading of 56.3.

In terms of Coronavirus developments, the French authorities put the Paris region on high alert from viruses, banned festive gatherings, and demanded all bars to close but allowed restaurants to remain open. With the number of infections increasing rapidly, Didier L'Alment, the Paris police official, announced that the new restrictions would be in place for at least the next two weeks. And we are constantly adapting to the reality of the virus. "We are taking measures to slow (its spread)," he said.

The French authorities consider bars to be one of the main places where the infection is spread because customers do not respect the rules of social distancing as much as they do in restaurants. As of Tuesday, bars in and around Paris will be closed. Student parties and all other festive and family events will be banned in establishments open to the public.

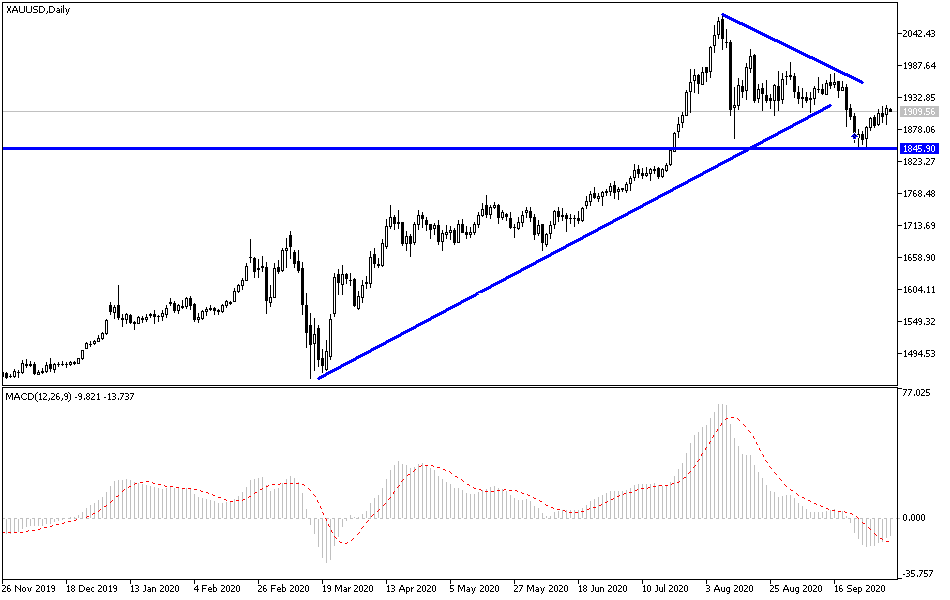

According to the technical analysis of gold: As I mentioned in the recent technical analyses, the stability of gold prices above $1900 an ounce will motivate the bulls to control the performance and start the technical launch towards higher resistance levels. The closest rebound levels to the current high are 1922, 1935, and 1960, respectively. Factors for gold's gains still exist - political anxiety in the United States - Trump's health - US-Chinese tensions - the strength of the second wave of the Corona epidemic - stimulus plans to support the global economy. On the downside, the support level at $1886 will remain the key to the resumption of selling and better control of the bears. I still prefer to buy gold from every lower level.

The price of gold will interact today with the extent of investor’s risk appetite, as well as the reaction from statements of European Central Bank Governor Lagarde and Federal Reserve Governor Jerome Powell.