Since the beginning of this week’s trading, gold prices have been trying to rebound higher. The opportunity was enhanced with the dollar's decline that the price of gold rose to $1920 an ounce at the time of writing. As we expected earlier, the opportunity is better for the yellow metal to rise due to several factors, most notably the beginning of the second wave of the Corona pandemic and the subsequent imposition of strict restrictions to contain the outbreak, which has infected more than 40 million person around the world. With advanced economies having the lion's share of that, placing pressure on the global economy as a whole. This is in addition to Brexit negotiations between the European Union and Britain reaching a dead end. It should also be noted that the future of the US presidential elections has a strong and direct impact on the US dollar and thus on the price of gold.

The weak dollar and some short selling contributed to the rise in the price of the yellow metal. The DXY dollar index fell to 93.00, down roughly 0.5% from the previous close. Regarding other metal prices, the December silver futures contract closed higher at $24.980 an ounce. December copper futures recorded their highest close in two years, settling at $3.1480 a pound.

As for economic data, data released by the US Commerce Department showed that building permits in the US rose 5.2% from the previous month to a seasonally adjusted annual rate of 1.553 million in September 2020, the highest level since March 2007. The rise was also above market expectations of 1.52 million. Meanwhile, the nation's housing starts increased by 1.9% to a seasonally adjusted annual rate of 1.415 million units in September 2020, from a downward-revised 1.388 million units the previous month. The September rally was lower than the market expectations of 1.457 million units.

On the stimulus front, US House of Representatives Speaker Nancy Pelosi said on Tuesday that she and Treasury Secretary Stephen Mnuchin are “on the way” to a huge deal to mitigate the Coronavirus effects, just hours before the deadline she herself set to reach a broad agreement with the White House. Pelosi is scheduled to speak to Mnuchin. It remains to be seen whether months of negotiations between the two parties will culminate in a massive stimulus plan just two weeks before the presidential elections.

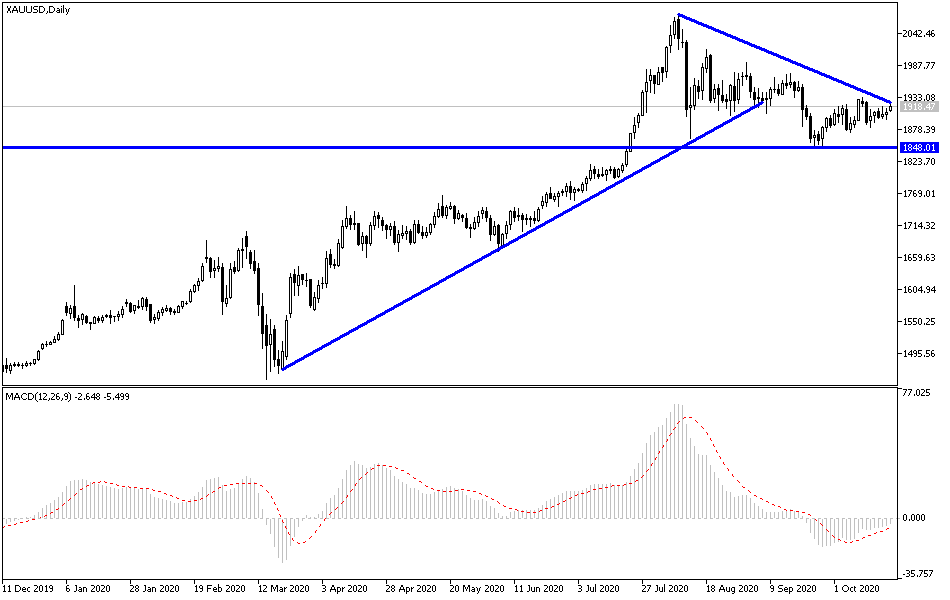

According to the technical analysis of the gold price: The bullish momentum of the yellow metal price will remain stronger as long as the price of gold is stable above the $1900 resistance. The bulls still need to move towards the resistance levels at 1927, 1940, and 1960 to confirm the control of performance for a longer period. In return, the support level at $1885 will remain the most important for the bears to return to controlling performance. According to the performance on the below daily chart, technical indicators are preparing to launch higher. All in all, I would still prefer to buy gold from every lower level, as global geopolitical tensions and the coronavirus linger for a longer period of time.