The flight from risk was ideal for the price of gold to move higher and reach $1911 an ounce at the time of writing. The price of the yellow metal is moving in a very limited range in a moment of price explosion in one of the two directions. Gold expectations hinge on hopes for a fiscal stimulus deal and the corresponding swings in real returns. Accordingly, gold prices may continue to fluctuate as the uncertainty surrounding the financial incentives and the Coronavirus persists. Gold price movement fluctuated in the 2% range during the recent trading sessions, as the gold price continues to search for a bullish catalyst in order to make a strong and real breakout. At the same time, with the current uncertainty surrounding the fiscal stimulus talks, gold prices may continue to move in a limited range.

Despite the significant rise in US Treasury bond prices in the past few weeks, the price of gold has remained remarkably stable due to the rising inflation expectations. Technically speaking, the 50-year forward inflation rate rose by 2.19% which is a new post-crisis high which helps to maintain pressure on real yields. At the same time, inflation hopes are increasing at a faster rate than the interest rate, causing rates of return to turn to a low level, indicating that it is a fundamental bullish factor for gold prices.

Expected inflation is likely to gain more ground with the prospect of another detailed fiscal stimulus package ahead of the November 3rd US elections. If there is an agreement between the two poles of US policy; Gold prices may see a new move higher on inflation expectations as the US dollar falls as markets seek certainty about the US fiscal stimulus.

And even if an agreement on financial aid is not reached before the election, inflation expectations may remain relatively high in the event that the odds of Democrats sweeping remain essentially as this would coincide with a much larger stimulus package next year. The possibility of a failure of the Congress could undermine inflation expectations and negatively impact the rise in gold prices.

On the other hand, Covid-19 fears have resurfaced with the increasing number of new record cases, which forced governments to impose more restrictions on commercial activities, which constitute another downside threat to the gold outlook. On the other hand, inflation expectations and gold prices may remain supported by the Fed's balance sheet.

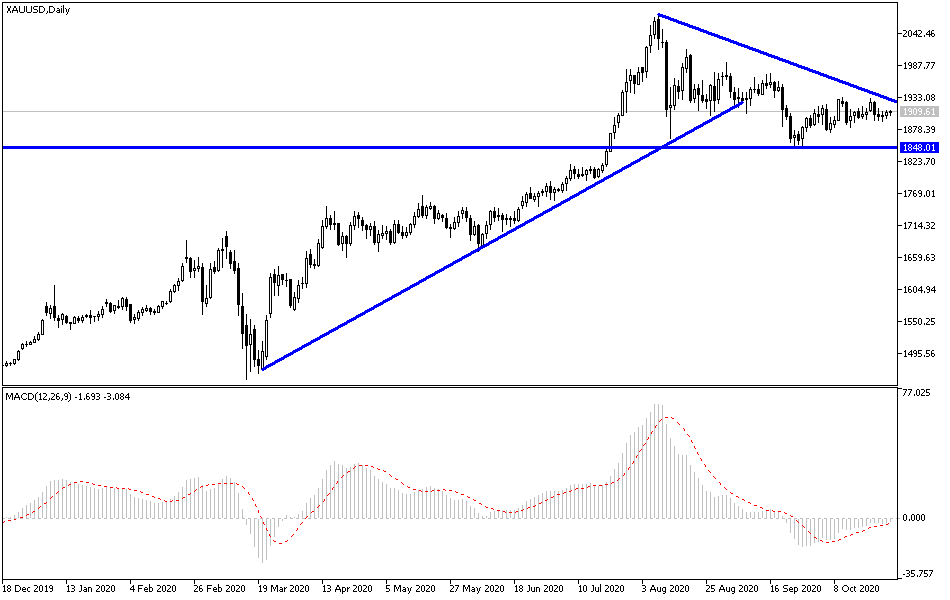

According to the technical analysis of gold: As there is no change in the movements, there is no change in my technical view of the price of gold performance, as the move is stable above $1900 an ounce and still supports the launch higher. The bulls' control over the performance will increase in the event that the gold price moves towards the resistance levels 1917, 1923 and 1940, respectively. On the downside, the support level at $1885 is still the most important one for the bears to start controlling the performance, and at the same time it is interesting for gold investors to think about buying.

I expect a new quiet day for the yellow metal performance today, with the economic calendar empty of important and influential data. The main driver today will be the extent of investors’ risk appetite, along with the price of the US dollar.