The return of the USD recovery contributed to halt gold gains at $1921, the highest in two weeks. The sales pushed the gold price to $1873 an ounce before settling around $1890 at the beginning of trading on Thursday. US stocks rose again, in response to US President Donald Trump's tweet that he would support aid to airlines and small businesses, and support another round of stimulus measures for Americans. US stocks had plunged in the previous session after Trump halted negotiations on a new coronavirus relief plan.

Silver futures ended lower at $23,896 an ounce, while copper futures settled at $3.0330 a pound.

Trump's surprise announcement dampened hopes for a rapid economic recovery, but markets are feeling some relief from new poll numbers that showed Democratic candidate Joe Biden's lead over US President Trump, as well as Trump's tweets that appear to promise to support individual parts of the fiscal stimulus. In addition, investors are pinning hopes that whoever wins the presidential election on Nov.3 will continue to submit a fiscal stimulus bill. A handful of national and international polls have shown that the margin for support for former Vice President Joe Biden is growing to double.

On another level, economists have warned that without more aid to the US economy, families across the country will struggle in the coming months to pay bills, rent, bear food costs and avoid eviction. It could also reduce the total income of Americans to below pre-epidemic levels by the end of the year, thereby reducing spending and slowing economic growth. During this week, Fed Chairman Jerome Powell made his believes clear that unless the government provides additional support, the recovery is in danger of derailment.

“Given what appears to be an increased probability of a second coronavirus wave, we are now predict a 50% probability of a recession over the next 12 months,” said Joe Brusolas, chief economist at tax advisory firm RSM. “If a major stimulus is adopted early next year, the likelihood of a recession will decrease” Brusolas added.

For its part, Oxford Economics predicts that without more federal aid, the economy will achieve an annual growth rate of only 1% in the current quarter, down sharply from its previous forecast of 4%.

Trump opened the door yesterday to the possibility of a narrower aid package that would boost certain industries, particularly airlines, or distribute another round of $1,200 stimulus checks to most adults. This prospect sent stock prices higher a day after they tumbled in the wake of Trump's tweet that ended the talks. However, there was no indication on Wednesday that a deal would be struck on a smaller scale. "The recovery will continue without it, but it will be a lot slower," Loretta Meester, chair of the Cleveland Federal Reserve Bank, said in an interview on CNBC. "We're still in a very big ditch."

According to a survey conducted by the Census Bureau on Wednesday, a third of adults in the United States are struggling to pay their usual expenses, including rent, food, car and utility payments. Economists say the unique feature of the current recession is that income rose in the April-June quarter by a record amount, even as more than 22 million people lost their jobs. The increase is caused by $1,200 worth of checks being sent to most families, while unemployment benefits have been boosted by $600 per week.

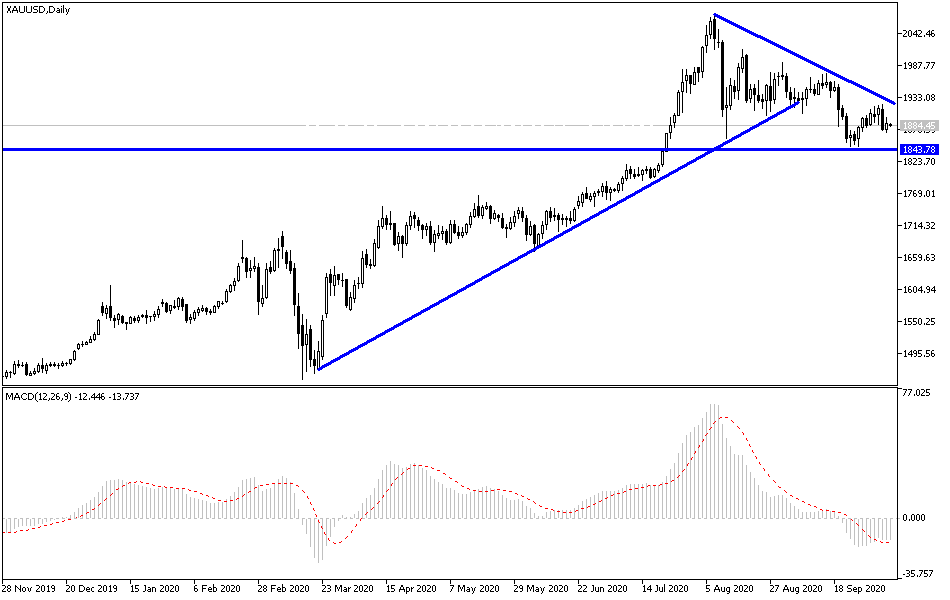

According to the technical analysis of gold: I still see that the recent decline in gold prices is an opportunity to think about buying the yellow metal again, as it is historically still a safe haven for investors in times of uncertainty, which has increased with the outbreak of the Corona epidemic since the beginning of the year 2020. Accordingly, support levels 1875, 1860 and 1845 will be the most appropriate ones for buying gold at the present time. On the upside, stability above the $1900 resistance will provoke buying again, as the general trend on the long term for gold is still bullish, amidst clear bearish momentum in the near and medium term.