For five trading sessions in a row, gold prices are moving in a limited range between $1883 an ounce and $1919 and stabilize around $1902 an ounce at the time of writing. This technical performance signals a strong movement coming in one of the two directions, and this depends on the global damage from the Coronavirus outbreak, as the total closure, as happened at the beginning of the year 2020, will support more demand for the yellow metal as a safe haven. This is in addition to a Brexit breakthrough or the lack of it and the stimulus efforts for the US economy, as well as the winner of the US presidential elections, which will be held early next month. The yellow metal is one of the traditional safe havens for investors in times of uncertainty, and the extent to which investors risk appetite will affect the future of the gold price.

As for the stimulus path to the US economy, the FOMC may come under a lot of pressure to publish more traditional tools as the deadlock in Congress increases the risk of a prolonged recovery. Therefore, gold may continue to reverse the inverse relationship with the US dollar as Jerome Powell remains committed to the Fed using a set of tools on a large scale to support the US economy.

As for the COVID-19 outbreak, the number of confirmed cases worldwide has exceeded the 40 million mark, but experts say this is only the tip of the iceberg when it comes to the true impact of the pandemic that has transformed life and work around the world. Despite this, the actual number of COVID-19 cases worldwide is likely much higher, as testing was uneven or limited, and many people did not show any symptoms, and some governments have hidden the true number of cases. So far, more than 1.1 million confirmed virus deaths have been reported, although experts also believe that this number is less than the real number compared to the number of infections.

As for the Brexit track - Britain and the European Union headed towards a resumption of their stalled trade talks on Monday, after the bloc's chief negotiator said he was ready to "intensify" negotiations on the legal text of the deal. Britain's Brexit minister hailed that as evidence of a major move from the European Union, three days after Prime Minister Boris Johnson announced that the talks were effectively over - a dramatic boom many believe was aimed at injecting momentum into the stalled process. Britain and the European Union have been trying to hammer out a new trade deal since the UK left the bloc on January 31, 2020.

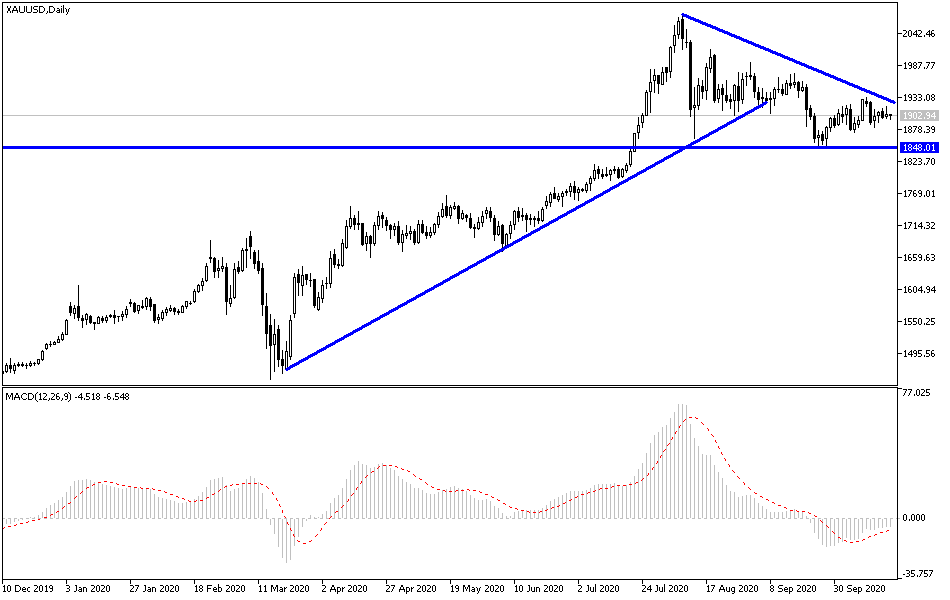

According to the technical analysis of gold: As I mentioned before, the stability of the gold price above $1900 per ounce supports the upward momentum, and according to the performance on the daily chart, the yellow metal moves within a triangle formation, and is closer to breaking the upper line, which supports the upward correction, and therefore, the move towards resistance levels at 1916, 1927 and 1955, respectively. On the downside, and as I mentioned before, the gold price moving around and below the $1882 support will end the current bullish expectations, and at the same time push the price of gold towards support levels to reinitiate buying. I still prefer to buy gold from every downward movement.

The most prominent economic data today: The announcement of the German producer price index, then the current account of the Eurozone. During the American session, building permits and housing starts will be announced.