The variance in performance happens as markets are waiting for the passage of the necessary stimulus plans to revive the US economy in the face of coronavirus. This is at a very sensitive time politically, as the presidential elections will be held next week. The US dollar has bounced from its lows due to a lack of concrete news about the new coronavirus stimulus bill.

The continuing increase in coronavirus cases around the world and new lockdown restrictions in many countries have boosted the price of the precious metal. According to the performance, the December silver futures contract closed higher by 0.034 dollar at $24.675 an ounce, while the December copper futures contract settled at $3.1290 per pound.

On the stimulus front, there are expectations that lawmakers will eventually agree to a deal. However, it seems unlikely that a bill will be passed before the next elections. House Speaker Nancy Pelosi recently suggested that negotiations with Treasury Secretary Stephen Mnuchin are making progress. During the last presidential debate on Thursday night, President Donald Trump accused Pelosi of delaying a new relief package until after the election for political purposes.

Trump also claimed that he might push reluctant Senate Republicans to support a broader stimulus bill if a deal is finally reached.

On the economic side, a report by the US Labour Department showed a decrease in jobless claims in the week ending October 17th. The ministry announced that initial jobless claims fell to 787,000, down by 55,000 from the previous week's revised level of 842,000. Economists had expected jobless claims to drop to 860,000 from the 898,000 reported in the previous week. Alongside the noticeable downward revision of the previous week's number, the report showed that initial jobless claims in the week ending October 3rd were revised down to 767,000 from 845,000.

The Department of Labour noted that the latest release reflects the actual census of California, which has completed its temporary pause in processing initial claims and resumed reporting actual unemployment insurance claims data.

On the other hand, according to the Beige Book report issued by the US Central Bank, economic activity continued to increase in all regions of the Federal Reserve. The report, which is a collection of all economic condition in the 12 Federal provinces, also said that overall industrial activity increased at a moderate pace, while housing markets continued to face steady demand for new and existing homes.

The US Federal Reserve stated that banking communications also indicated increased demand for mortgages as the main driver of overall loan demand. Meanwhile, the Fed said conditions for commercial real estate continued to deteriorate in many areas, with the exception of warehouses and industrial spaces where construction and rental activity remained flat.

The report also said that consumer spending growth remained positive, but some regions reported stabilizing retail sales and a slight increase in tourism activity.

The Fed also said that employment increased in nearly all regions, although growth remained slow. Job gains were reported more consistently in manufacturing companies, but companies continued to report new vacations and layoffs.

On the US inflation front, Big Book said prices have increased modestly across regions since the previous report. Input costs have generally increased faster than consumer prices, although some sectors - notably construction, manufacturing, retail and wholesale - have passed the higher costs onto consumers.

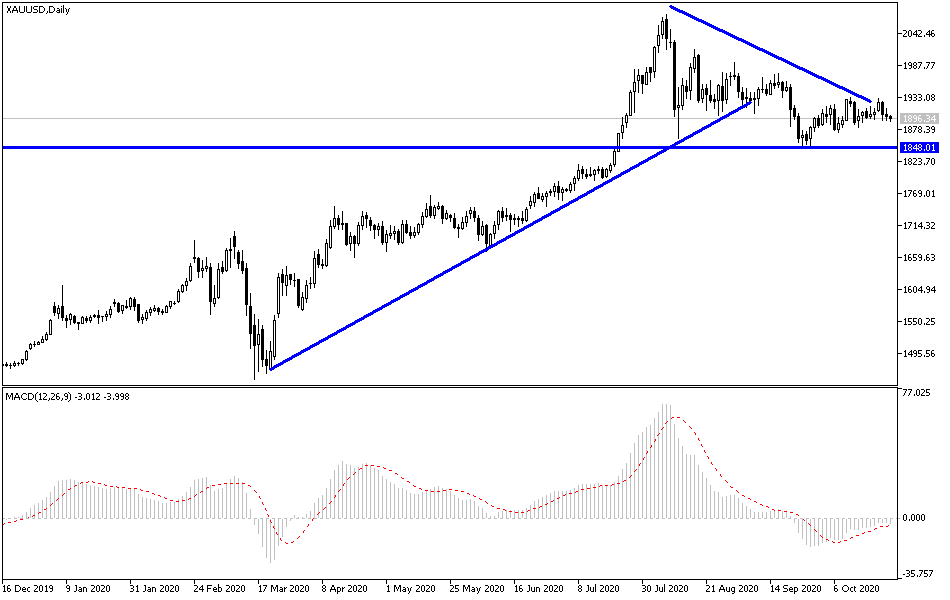

According to the technical analysis of gold: On the near term, it appears that the price of XAU/USD is trading within a slightly ascending triangle formation on the hourly chart. This indicates a slight upward slope in the short-term market sentiment. And the formation of the consolidation pattern could lead to a temporary breakthrough. Accordingly, bulls will be looking for a possible bullish breakout by targeting profits at around $1.919 or higher at $1940. On the other hand, bears will be looking for short-term profits at around $1881 or less at $1859.

On the long term and according to the performance on the daily chart, it appears that the price of gold is trading within a bullish channel. This indicates a strong long-term bullish bias in market sentiment. The yellow metal price is a far from the overbought region of the 14-day RSI. The current trend could continue over the next month. Accordingly, bulls will look to maintain long-term control over gold by targeting profits at around $1962 or higher at $2,046. On the other hand, bears will be targeting long-term reverse profits of around $1,815 or less at $1,738.