The decline of the US currency was a long-awaited catalyst, and therefore the opportunity was better for the yellow metal to rise. Accordingly, the price of gold rose to $1930 an ounce, its highest level in three weeks. Last Friday's trading session was the best daily performance for the yellow metal since the end of August. The dollar's weakness amid hopes of stimulus and data showing significant growth in Chinese service sector activity in September helped lift the price of the precious metal. During last week’s trading, the price of gold rose by about 1%. Also, silver futures rose to settle at $25.108 an ounce, while copper futures settled at $3.0825 a pound.

According to reports supporting recent market moves, White House Economic Adviser Larry Kudlow said that US President Donald Trump has approved a revised stimulus package. Kate Davidson of the Wall Street Journal tweeted that US Treasury Secretary Stephen Mnuchin will present House Speaker Nancy Pelosi with a counter-offer of $1.8 trillion for the Democrats’ $2.2 trillion plan.

On the economic side, the Caixin Services PMI in China rose to 54.8 in September from 54.0 in August, marking the fifth consecutive increase in service sector production. Growth was boosted by a steady increase in total new business.

Investors are also preparing for Biden's victory in the US presidential election and expect he will deliver a bigger stimulus package after the election.

Global financial markets and investor sentiment will be affected by the new outbreak of Covid-19, as many countries are witnessing a new intensification of the spread of the deadly virus, including large swaths of Europe and more than half of the American states. Accordingly, new social distancing rules are (re) imposed, which cannot have constructive economic consequences in the short term. Canada's Trudeau warned that his country was at a turning point in the second wave. In the United States of America, more than 7 million people have been confirmed infected with COVID-19 since the virus began spreading earlier this year, according to figures from Johns Hopkins University.

Across Europe, including the UK, there have been huge increases in coronavirus cases over the past few weeks after the reopening of large sectors of the economy, as well as schools and universities. Infection levels - and deaths - in the UK are rising at their fastest rates in months. Without prompt action, there are concerns that UK hospitals will be overwhelmed in the coming weeks at a time of year when they are already in their most crowded winter conditions with illnesses like influenza. The UK saw the most lethal outbreak in Europe, with the official death toll reaching 42,825, up by 65 more cases on Sunday.

Although Coronavirus cases have risen across England, northern cities such as Liverpool, Manchester, and Newcastle have seen a disproportionate increase. While some rural areas in eastern England have fewer than 20 cases per 100,000 people, major metropolitan areas such as Liverpool, Manchester, and Nottingham have recently recorded levels above 500 per 100,000, which is nearly as bad as in Madrid or Brussels.

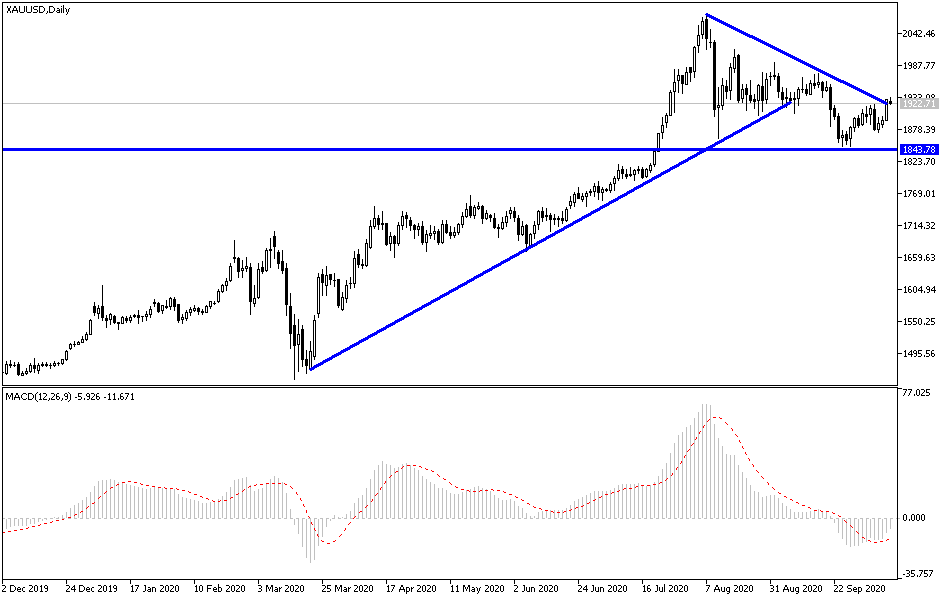

According to the technical analysis of gold: As I previously expected, gold stability around and the above the $1900 resistance will motivate more buying, and therefore gold will move to the top, especially if it coincides with a drop of the US dollar. The strength of the second wave of the Corona epidemic, political anxiety in the United States, and the flight of investors from risk will remain the most influential factors on the path of gold in the coming days. Currently, resistance levels are at 1942, 1960, and 1975, respectively, will be the next bulls' goals, and if they broken, they will support the movement towards historical psychological resistance at $2000 again. On the downside, bears will regain control if the gold price moves below the $1900 level again.

I still prefer to buy gold from every decline. Quiet moves are expected today in light of the US holiday and the economic calendar is empty of important or influential announcements.