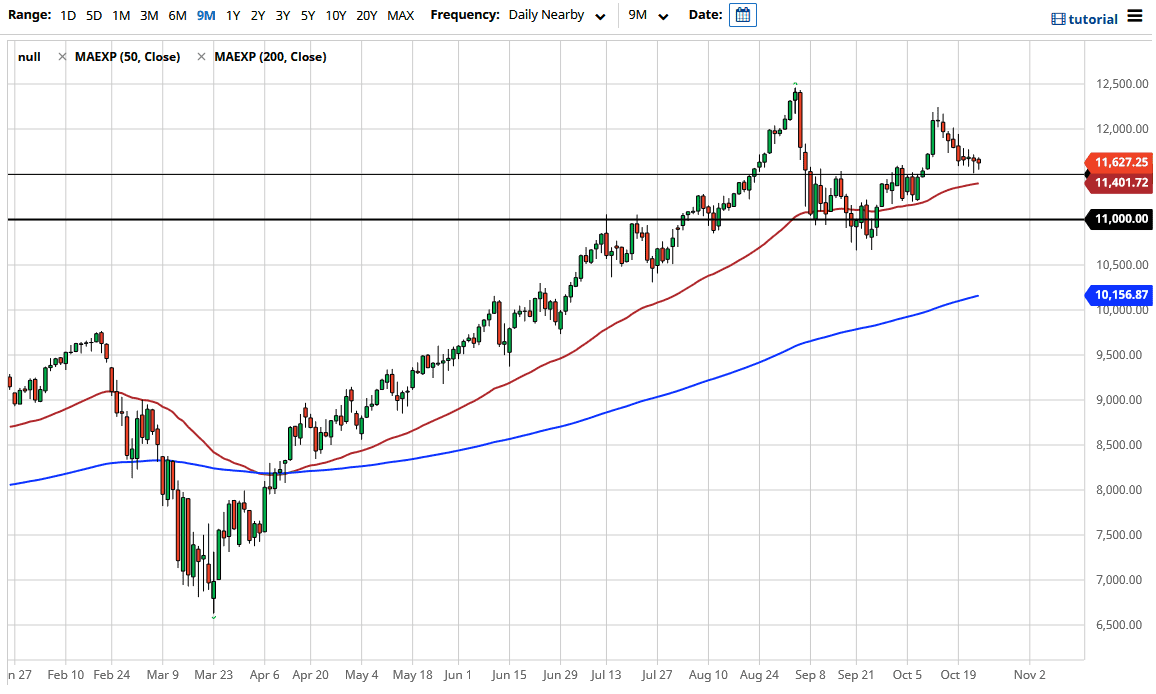

The NASDAQ 100 has fallen a bit during the trading session on Friday, as we reached towards the 11,500 level yet again. This is an area that has been important more than once because it was the scene where we broke out of previously, and now we are retesting that area. It will be interesting to see how things play out from here, because not only do we have that information, but we also have the 50 day EMA coming into the picture where certain longer-term traders will be paying close attention to as well.

Looking at the chart, it is also obvious that perhaps we are in an area where all we need is a little bit of a catalyst to go higher in the form of good news, maybe stimulus. However, the one thing that I think we are looking at is a scenario where people will come in and try to pick up value given half a chance, so I do like the idea of buying as soon as we can break above the last four candlesticks. On the other hand, if we do drop down lower, I like the idea of buying value if it occurs. In fact, even below the 50 day EMA I think there is plenty of support at the 11,000 level as well. Looking at this chart, it is obvious to me that you cannot sell it, because quite frankly we have been in an uptrend forever. It is not until we break down below the 10,750 level that one would have to think that it is in serious trouble. That being said, the NASDAQ 100 is driven by a handful of stocks that everybody loves, so I think we will eventually find a reason to go higher.

If stimulus comes, that will more than likely since stocks much higher as well, as we would see cheap money flowing into the system and everybody would celebrate again. Ultimately, that is exactly what will happen given enough time, so everybody on Wall Street is simply picking their spots in trying to get involved. That being said, the target eventually is going to be the highs again. Furthermore, we will probably continue to go even higher as there simply does not seem to be much of an alternative anytime soon.