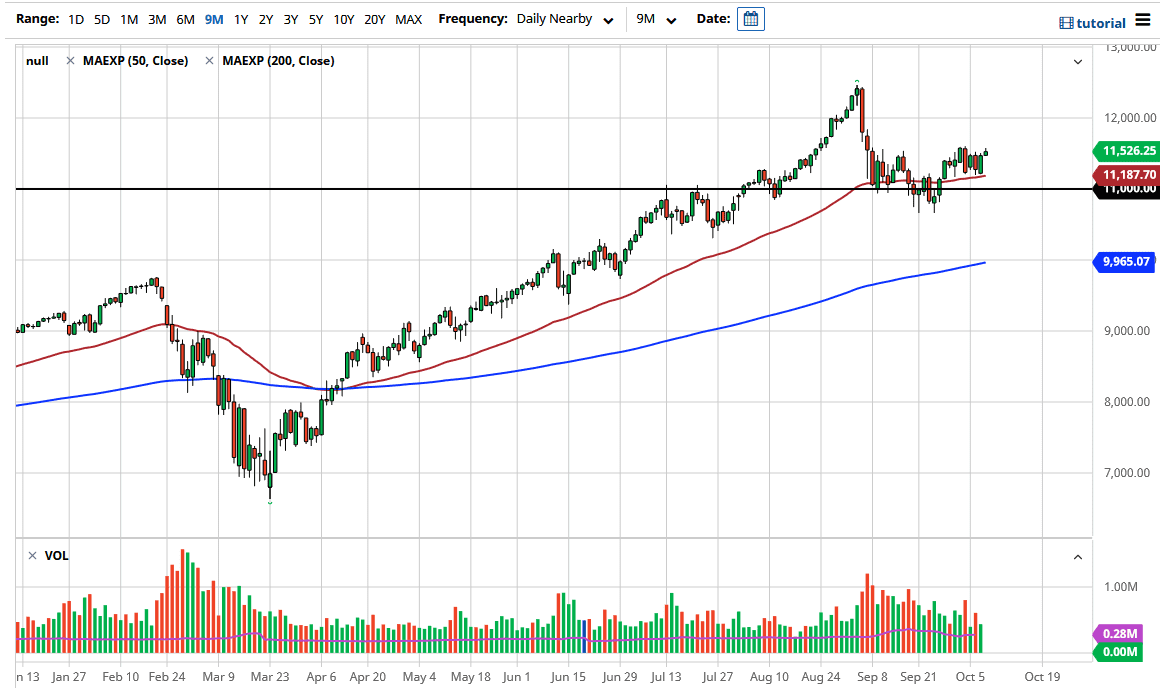

The NASDAQ 100 initially tried to rally during the trading session on Thursday but cannot quite break out to the upside. The NASDAQ 100 it did not follow the S&P 500 in taking off to the upside, so this is something worth paying attention to. Having said that, pullbacks at this point should see plenty of support underneath at the 50 day EMA. Underneath there, the 11,000 level should offer support as well. I do not have any interest whatsoever in trying to short this market, at least not right now. I think that this market will probably have plenty of buyers underneath to take advantage of dips.

The market will continue to move based upon a handful of stocks, as just six stocks move roughly 44% of this index. In other words, the market is likely to follow Microsoft, Facebook, Alphabet, Netflix, Apple, and a handful of others. In other words, the NASDAQ 100 is not an equal weighted index, so if you get those handful of stocks right, you get this index rate.

The US dollar could have its say when it comes to which direction we go as well, because of the US dollar suddenly starts to strengthen, it could weigh upon stocks as well. If we break above the 11,550 level on a daily close, then the market is likely to go looking towards the 12,000 level, perhaps even towards the 12,500 level which was the all-time high. Pullbacks at this point time should continue to offer plenty of buying opportunities, so I think that is how a lot of traders will trade this market. As far as selling is concerned, we would need to make a fresh low, which is closer to the 10,675 level, an area that we are nowhere near right now. If we break down below there, the market is likely to go looking towards the 200 day EMA, which is closer to the 10,000 handle. A breakdown below that would technically break the entire uptrend. We are nowhere near that, so I anticipate that we will continue to see equity traders come in and buy the dips, although it certainly looks as if we are rotating and therefore perhaps the NASDAQ 100 will continue to lag going forward as it has for the last several days. Either way, it looks very likely that the market will continue to go higher given enough time.