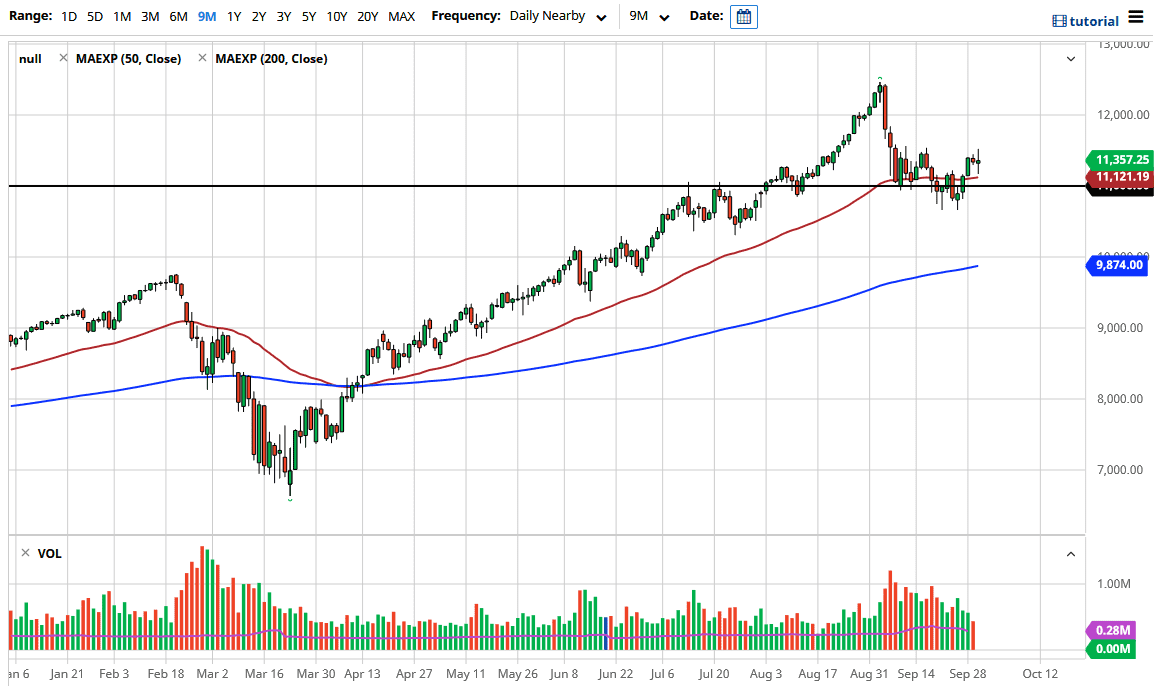

The NASDAQ 100 had a very volatile trading session during the day on Wednesday, as it was the end of the month and the end of the quarter. A lot of money flew in and out of the markets, in order for funds to balance their books again. Ultimately, this makes for a lot of noise, and you can see that is definitely the case during the day as we ended up forming a very neutral candlestick, despite the fact that we fell rather hard and rallied rather hard at one point.

Looking at this candlestick, it tells you just how confused everybody is, but it is worth noting that the 50 day EMA has offered a bit of support. Furthermore, with the 11,000 level underneath offering significant support, I am not necessarily looking for some type of major breakdown. Quite the contrary, I believe that the market is trying to figure out what to do next, and as a result, it would make quite a bit of sense to see a lot of choppy behavior. At this point, it looks as if we are trying to form some type of consolidation, and therefore I think that you are probably looking at a market that wants to go back and forth between the 10,600 level on the bottom, and the 11,550 level on the top. In other words, we continue to bounce back and forth around the 50 day EMA and the 11,000 handle overall.

If we do break to the upside, it could unleash the NASDAQ 100 to go looking towards the 12,000 handle, but at this point, I think that would probably be based upon stimulus hopes coming out the United States more than anything else. Regardless, even if we do rally, we may need to have a little bit of momentum built up in order to make that happen. It is due to the US dollar because it seems to have a bit of an inverse correlation as of late. If the US dollar can continue to fall, that could help the NASDAQ 100 but at the end of the day, it all comes down to risk appetite more than anything else. Regardless, I do not have any real interest in shorting this market and I think that you should look at pullbacks as potential buying opportunities although I recognize we may not do much between now and the election.