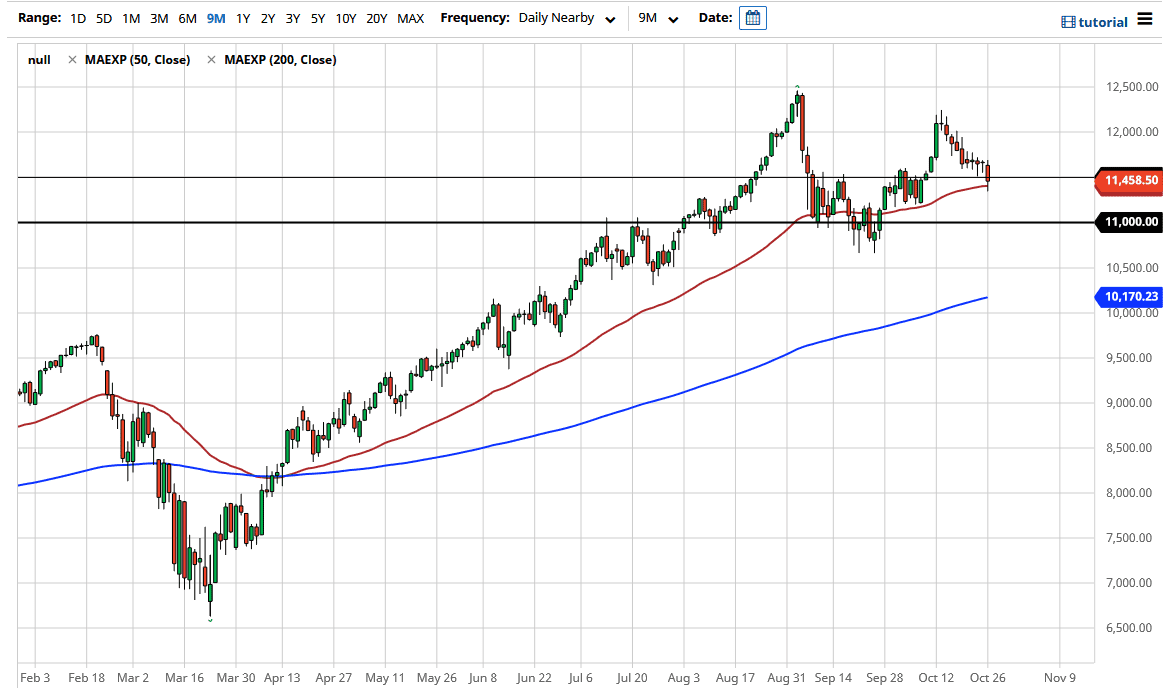

The NASDAQ 100 went back and forth during the trading session on Monday, mainly to the downside as we initially tried to rally during the Asian session. We have broken down from there to reach below the 11,500 level, reaching down towards the 50 day EMA. By breaking down below that area, we did find a certain amount of support, and we did break back above the 50 day EMA. Having said that, the most important thing to pay attention to at this point in time is that we did break the back of a couple of hammers.

The market of course is one that is been very noisy, and therefore it is worth paying attention to the fact that this candlestick is longer, but having said that it is likely worth paying attention to the fact that we may get a little bit more negativity in the short term. After all, there is almost no chance at stimulus in the short term, and depending on how the election turns out, it may be several months before we get any type of stimulus and that could bring the market down. Having said that, the market has plenty of support in that general area we are at right now, and again at the 11,000 level.

Wall Street has a significant ability to find the reason to buy stocks regardless of what happens, so that is most certainly something worth paying attention to. With that being the case, I think it is difficult to imagine any scenario where I will be a seller. Even if this market were to break down quite drastically, I would be a buyer of the United States dollar if we break down here, because the indices are not built to be shorted, as they are not equal weighted. Because of this, if I believe that the stock market is going to have the bottom fall out of it, it is best to simply buy the US dollar against other currencies. The much easier trade and is not necessarily geared to cause as much pain as possible. However, at that point I am also willing to step on the sidelines look for an opportunity to go long again. If you look at the history of stock markets over the last 12 years or so, that has clearly been the play. I have no interest in buying here, but I think we will get an opportunity and a few sessions.