The NASDAQ 100 has gone back and forth during the trading session on Wednesday, as we continue to see whether or not we get some type of stimulus out of the United States. Most traders believe that it is in fact going to happen, but the reality is that it has not yet, and politicians very rarely can act like adults. With this, a lot of traders have been buying based upon hope, but it is worth noting that we have not gotten any concrete answers.

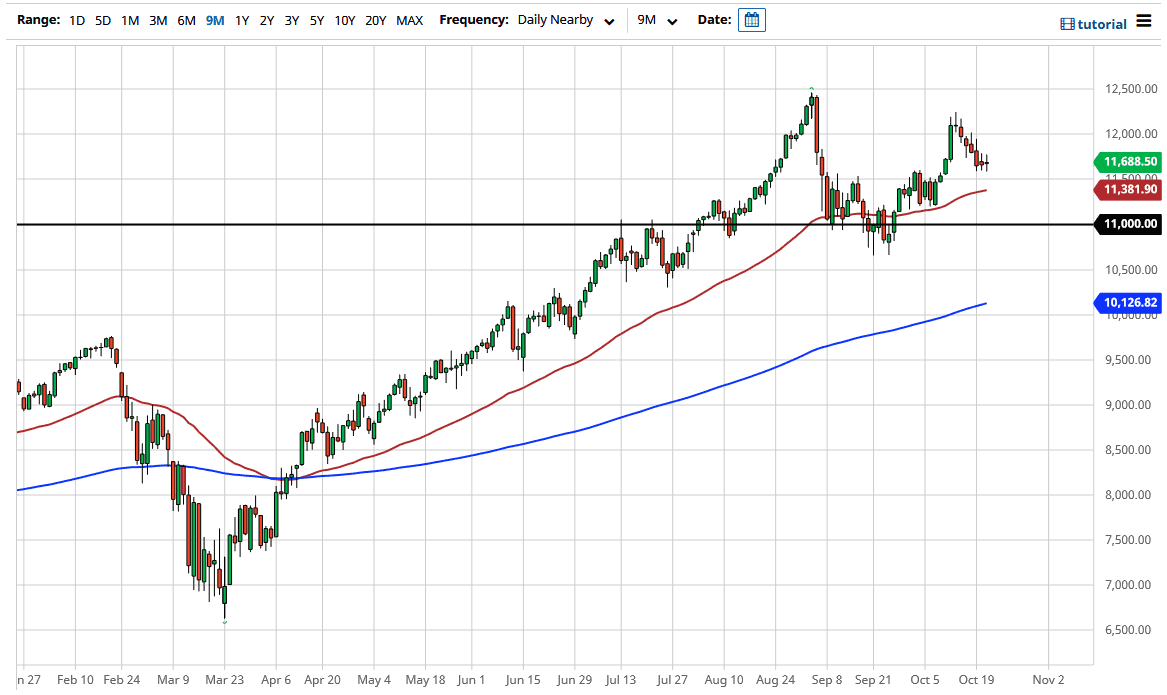

Just below, the 11,500 level should offer plenty of support as it was previous resistance. All things being equal, I think that area will hold up but even if we were to break down below there, we have a massive amount of noise between that level and the 11,000 handle, so it does make sense that we would see buyers jump in. I am looking for some type of supportive daily candlestick in that range to take advantage of if we get that opportunity. Having said that, there is also the possibility that we break above the high of from the trading session, and then go looking towards the 12,000 level. That is an area that has a certain amount of psychological resistance, and we have a shooting star that formed just above it. If we can break past that level, then we could go to the highs.

The biggest problem is not only the stimulus issue, but it is also the possibility that we are going to look towards the Department of Justice lawsuit against Google as a precursor to a lot of trouble and it comes to the mainstays of the NASDAQ 100. With that being the case, I like the idea of looking for value, because you will get plenty of a given enough time. The 10,600 level offers a very significant support level, and then below there you would be talking about reaching towards the 200 day EMA. As things stand right now though, I believe that we will not get anywhere near that and it is only a matter of time before buyers jump back in as they typically always do. The next two weeks could be very choppy though, as we head towards the election