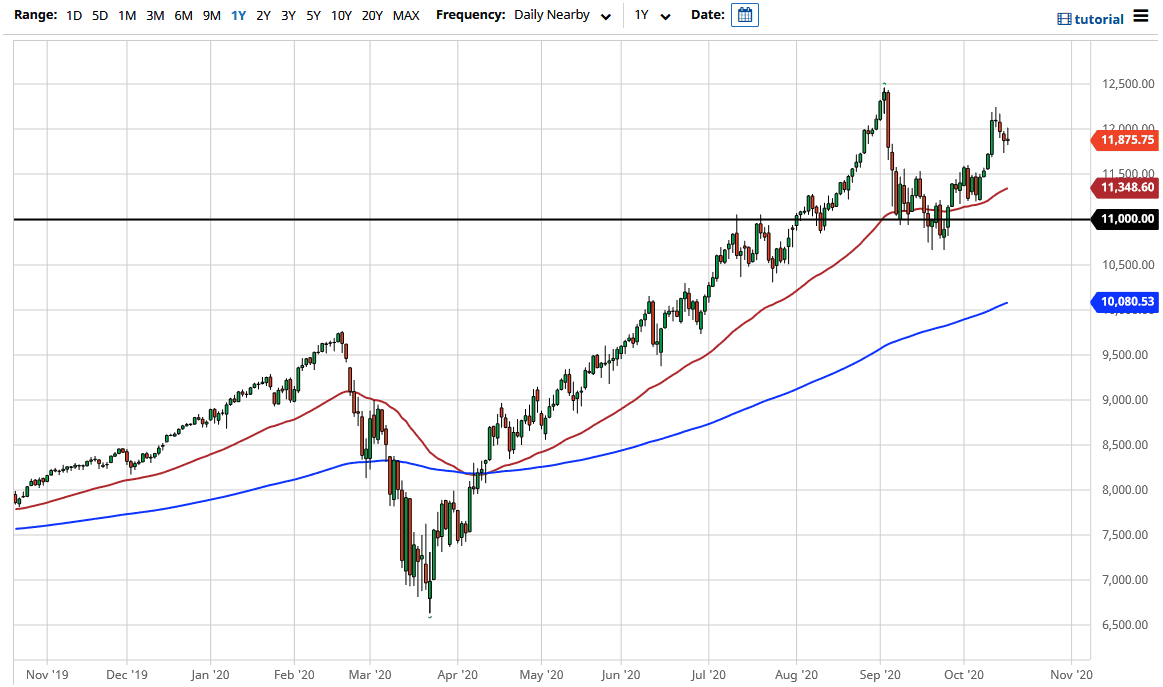

The NASDAQ 100 initially tried to rally during the trading session on Friday but found the 12,000 level to be a bit resistive. Having said that, the Thursday candlestick was a hammer and should offer at least a little bit of support. However, that Thursday candlestick was formed basically in the middle of nowhere, and not in an area that I would expect to see a lot of demand. Because of this, we very well could drift below the candlestick and go looking for much more in the way of demand when it comes to the market.

Looking at the shape of the candlestick, it certainly shows that we are at least short-term negative, but I think at this point you cannot short the market. You are simply looking for opportunities underneath to pick up the NASDAQ 100 index “on the cheap.” After all, the market has continued to find plenty of reasons to go higher and I think that will continue to be the case if you give it enough time. Furthermore, there is a significant amount of support closer to the 11,500 region.

I had somebody email me earlier asking me if the market was trying to form some type of bullish flag. I guess in theory you could say so, but even that seems to be a bit of a stretch due to the fact that we are still concerned about stimulus issues, and now Congress is talking about giving subpoenas to various technology companies CEOs from Twitter and Facebook. At this point, it looks like Silicon Valley will have a target on its back from most politicians on both sides of the aisle so that certainly will have an influence on this index. I am not saying that we cannot go higher, and I think we do eventually. However, in the short term, there are a lot of things in the wind that could cause some issues. Stimulus seems to be on hold at the very least, so we could see the US dollar strengthened a bit, which works against stocks in general. All things being equal, I think that we got a nice little pullback here that we can take advantage of as it should offer value in reference to the larger trend. Looking for value continues to be the best way to trade this index.