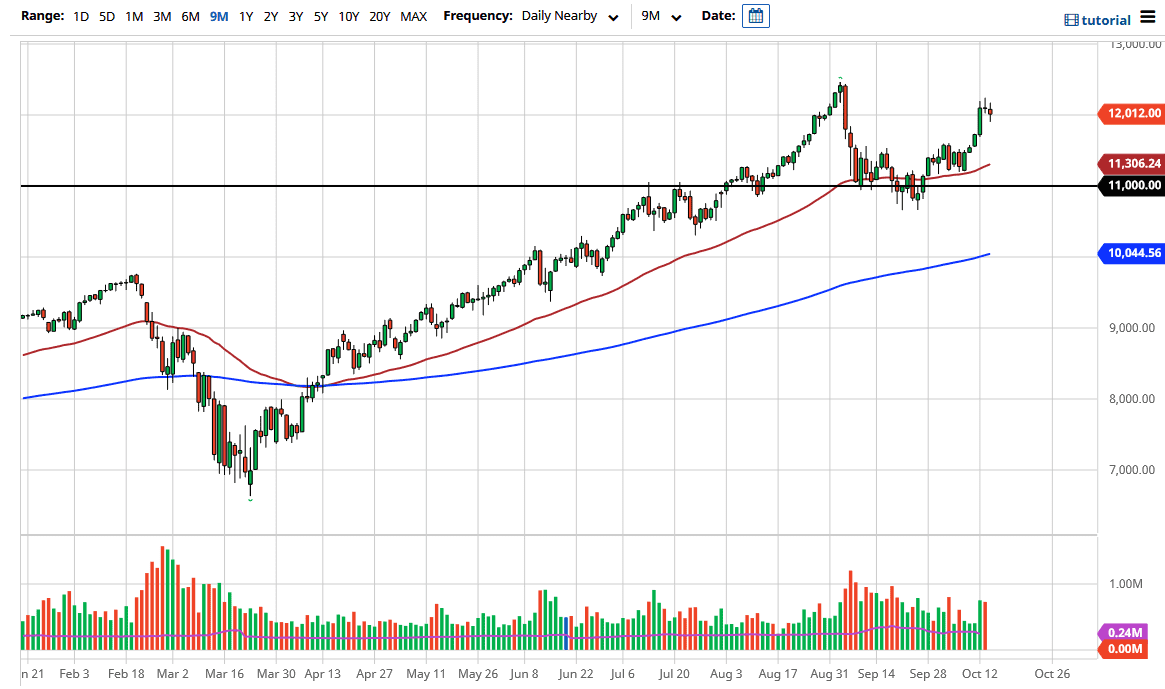

The NASDAQ 100 went back and forth during the trading session on Wednesday, as we continue to dance just above the 12,000 level. Ultimately, this is a market that I think is trying to find a reason to go higher, but we had gotten a bit ahead of ourselves. Keep in mind that the Tuesday session was a significant shooting star, and that will attract a certain amount of attention in and of itself. Having said that, we also have to keep in mind that this market is moving almost solely upon the idea of stimulus right now and we are waiting to see whether or not we actually got it.

Looking at the market, I think that we could pull back towards the $11,550 level, which was an area that was significant resistance previously. Ultimately, I think that is an area where we could see a lot of pressure to the upside, and perhaps even more value hunting. This is a market that sees a lot of noise between there and the 11,000 handle, and the NASDAQ 100 is highly levered to a handful of stocks that everybody on Wall Street buys. Because of this, it is impossible to short this market, and you simply look for buying opportunities lean certain stocks get on the cheap side. For example, the handful of stocks such as Netflix, Amazon, Apple, Microsoft, Alphabet, Facebook, and a handful of others dictate where we go. The top six stocks in this index control over 40% of the momentum.

When you look at this chart, some people are seeing a potential double top, but I think it is simply a pullback as we continue to see a lot of questions as to whether or not we get stimulus. Quite frankly, I think there are plenty of buying opportunities underneath and I am simply going to let the market fall in order to pick up value. I have no interest in shorting, and in fact have been much happier once I realized that these markets are not built to fall, and with central banks out there pushing them higher every time they need to, you are better off waiting for opportunities to pick them up “on the cheap” and simply collect profits. If we break above the all-time highs, I would be a bit nervous because it would be a bit too parabolic at this point.