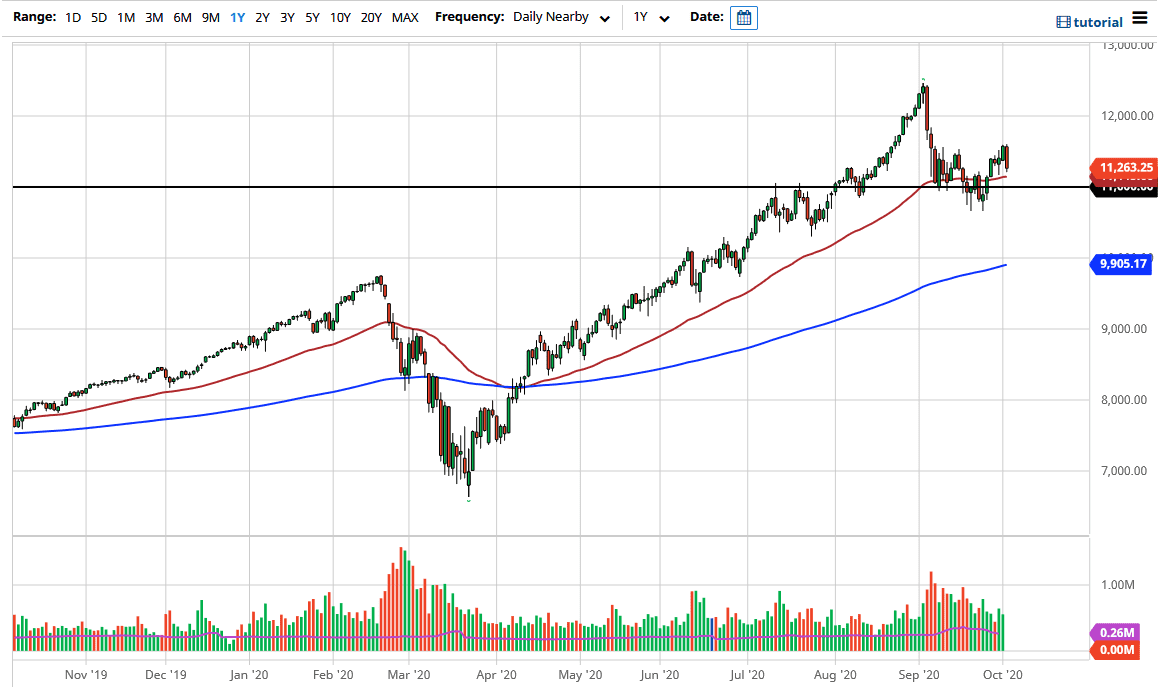

The NASDAQ 100 had a miserable day on Friday as there was more of a “risk-off” feel to the technology stocks, which is interesting considering they have not let the market go higher for the longest time. The S&P 500 showed signs of building support during the day, so I think at this point it is likely that the NASDAQ 100 could pull things back down. The 50 day EMA sits just below, so it is possible that it could offer a bit of support, and most certainly the 11,000 level well.

Looking at this chart, we have recently broken through an uptrend line, but I think it is not until we clear the 10,650 level that I would be tempted to short this market. A break down below there then opens up the possibility down to the 9900 level or essentially the 200 day EMA that sits there now. Looking at this chart, it looks like we were going to break out, but we turned around quite rapidly and then simply could not recapture the gains, unlike the S&P 500. This is interesting, because there are a handful of stocks out there that continue to put the NASDAQ 100 higher.

That being said, I think that we are looking at a very choppy and volatile range that we are currently in the middle of, and the market is likely to see a lot of reactionary forces due to the coronavirus situation in the European Union and the United States. Furthermore, we have to worry about the economy slowing down as people are starting to think about lockdowns again. With the president contracting coronavirus, there are people concerned about whether or not things are going to suddenly get worse. Now that we have the election, and a whole host of other issues like riots and a strengthening US dollar. In other words, the market has a whole host of risk out there that could come into play, and thereby I think there is serious risk to the downside although you cannot simply sell right here. If we break above the highs for both Thursday and Friday, then I think that shows that a lot of momentum will enter the market would probably go looking towards the 12,000 handle rather quickly.