The NASDAQ 100 has gapped higher to kick off the trading session on Monday, reaching towards the middle of that massive candlestick from Friday. Ultimately, we did close towards the top of the range for the session, but it would be a bit of a stretch to suggest that the market has suddenly exploded to the upside. All things being equal, this is about a handful of stocks as per usual, so pay attention to the usual suspect such as Microsoft, Apple, Amazon, Alphabet, Facebook, and others such as Tesla and Intel. As long as the market sees those markets going higher, it will also drive the NASDAQ 100 higher.

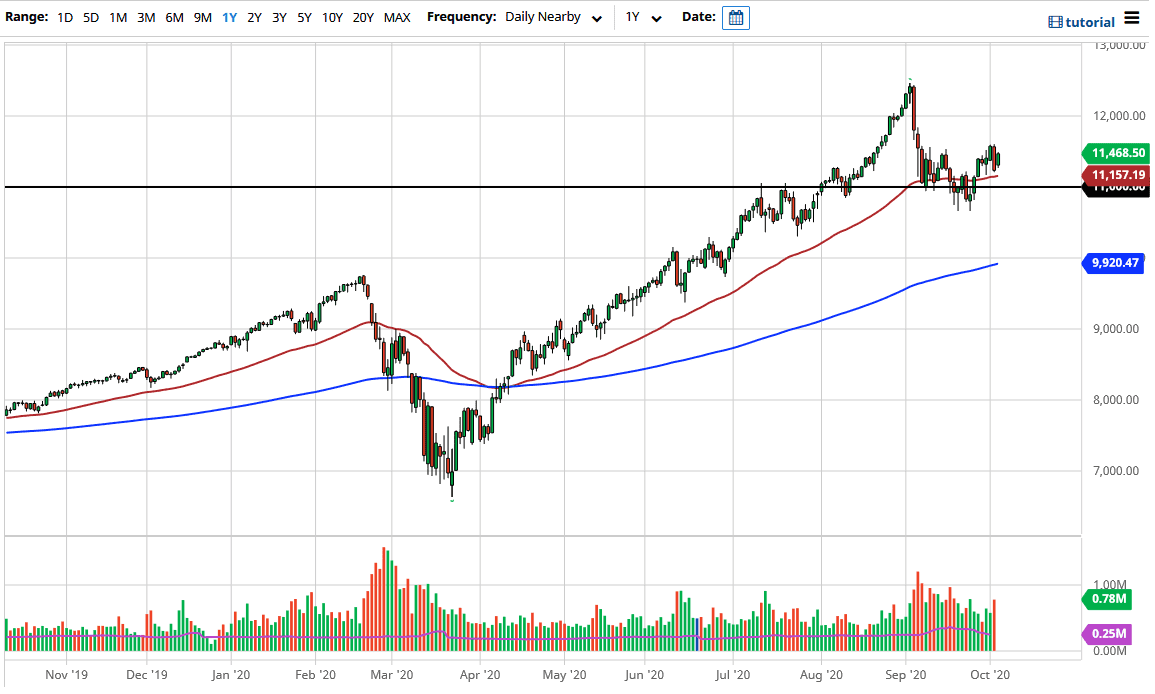

To the downside, it looks as if the 50 day EMA is going to continue to see a lot of interest in, and the 11,000 level underneath there also offers a significant amount of support as well. Because of this, I believe it is only a matter of time before buyers will come back and pick up value as it occurs. Ultimately, this is a market that I think will see a lot of value hunting going on ahead, as we have seen more than once. In fact, it is not until we break down below the 10,600 level that I would be concerned about the uptrend, so therefore I like the idea of buying dips, much like the rest of the world seems to.

Looking at this chart, I think that we are more likely than not to go higher, breaking above the 11,600 level giving the “all clear” to continue going towards the 12,000 handle. Fundamentals no longer matter as we continue to see the market move more or less on liquidity and stimulus than anything else. Ultimately, I think that the market is trying to build a bit of a base, and it is probably only a matter of time before we do eventually break out. The markets will continue to look for stimulus and a bailout when it comes to the Federal Reserve and Congress. Traders are starting to bank on that happening, on the old “reflation trade”, so now that they are starting to look at possible Joe Biden win, that could bring more hope for cheap money to the table. All things being equal, I have no interest in shorting this market due to the fact that it is so well supported underneath.