The NASDAQ 100 continues to be very noisy, but at the end of the day it is an index that should never be shorted. This is because the market is highly levered to a handful of stocks that Wall Street loves. That is not going to change in the month of November, so at this point time I am looking for opportunities to pick up value. Ultimately, the market has tried to make a “higher high” during the month of October, but it failed. That is not to say that we are looking at a “double top”, as it is still supported at multiple levels underneath.

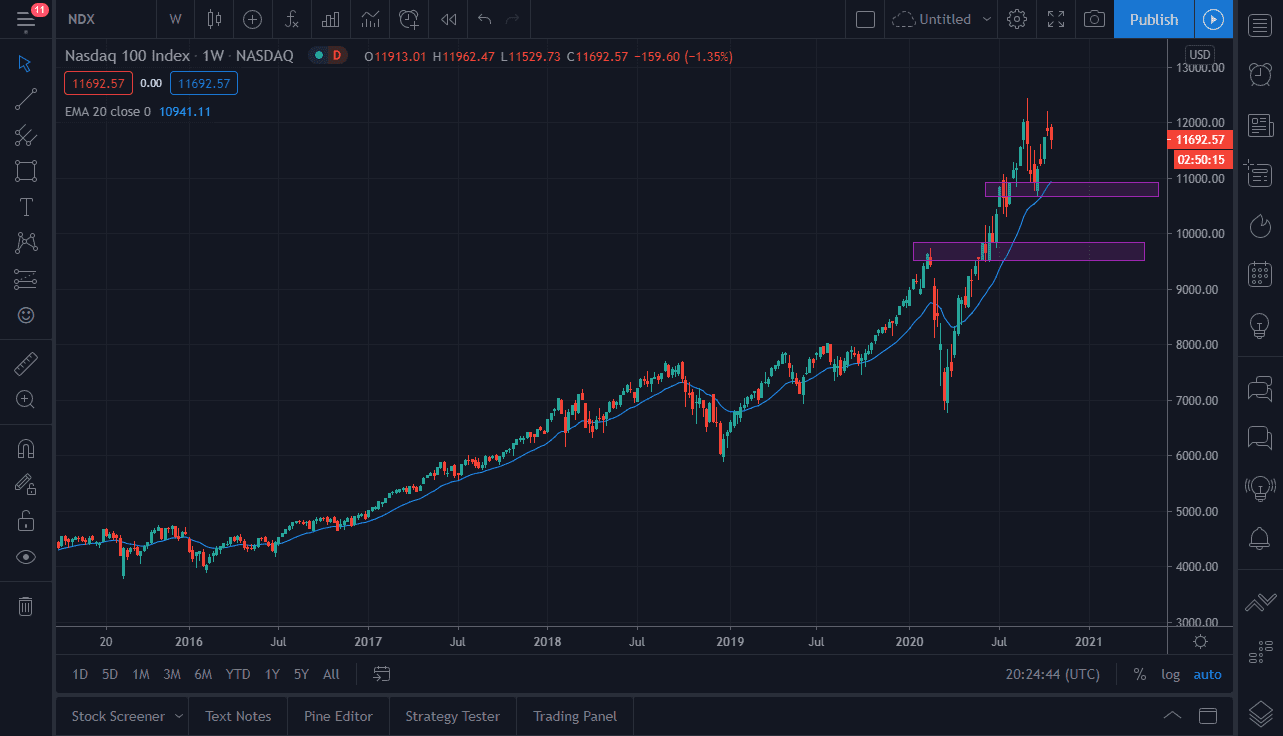

The 20 week EMA is at the most recent low and sitting just below the 11,000 level. The 11,000 level is a large, round, psychologically significant figure, and of course an area where we have seen a little bit of buying pressure previously. It is not until we break down below there that it will technically be a “double top”, but even then, I think it is only a matter of time before you find buyers again. That would be just below the 10,000 level, and it makes sense that buyers would be looking for that as an opportunity as well.

The NASDAQ 100 should continue to show bullish pressure due to the fact that the market is driven by basically the following stocks: Netflix, Alphabet, Facebook, Microsoft, Apple, Tesla, Intel, and a few other ones. At this point on, the market is likely to have buyers looking for value every time they see a dip, as has been the case for a while. Furthermore, you can make an argument for the 50% Fibonacci retracement level which is just below the 10,000 level as well. All things being equal, this is a market that I think continues to see traders by every time they get a hint of either stimulus or value. Even if we break down below the 50% Fibonacci retracement level there is no way that I would be shorting the market, because if we do get some type of major breakdown, the reality is that the Federal Reserve or somebody will come in and start bailing people out. That is just the way this works so shorting an index in the United States is simply impossible. I suspect that the beginning of the month might be a bit negative, but value hunters will certainly come back and try to take advantage.