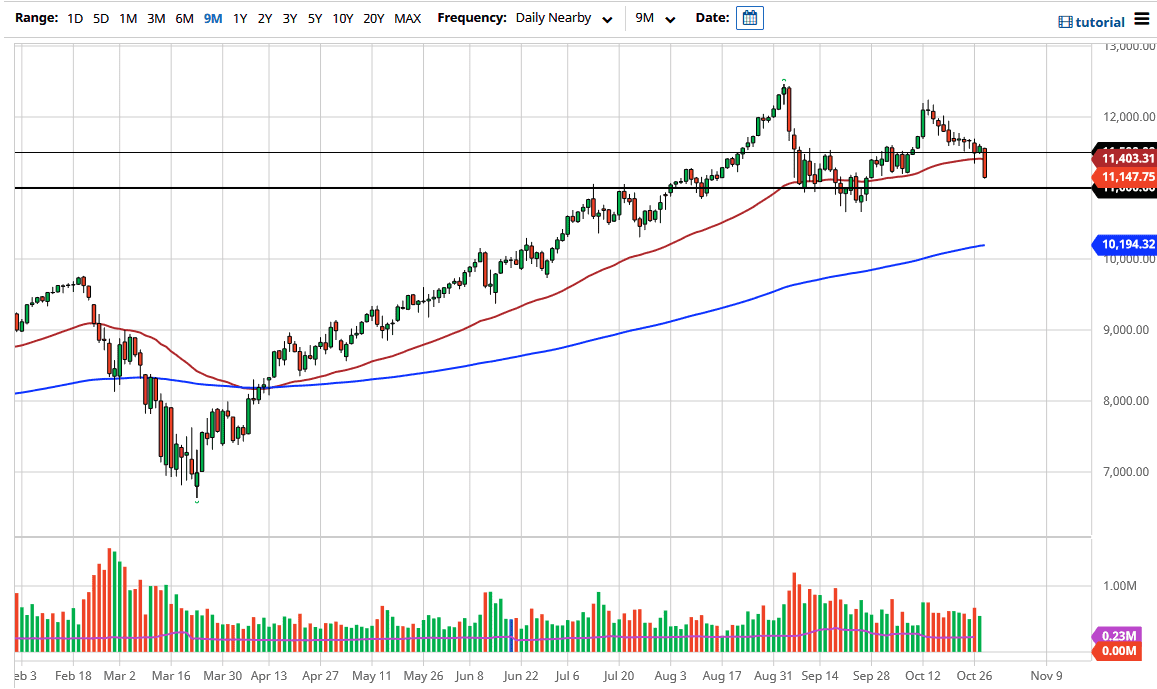

Looking at this market, we have also broken down below the 50 day EMA, so that is another reason to think that perhaps sellers are going to become a bit aggressive. By breaking down the way we did in the stake in the fact that we close that the very bottom of it suggests that we are going lower. Furthermore, the 11,000 level is an area where people will be interested, as it was a previous support level. That being said, the NASDAQ 100 of course is extraordinarily volatile, but it is one of the first places that people will get involved in.

If we bounce from this general area underneath, there is likely that there will be a lot of support in that general range it could have the market turning back towards the 11,500 level. If we can break above there, then the market likely going towards the 12,000 level. On the other hand, if we break down to clear the lows of September, we could probably go down towards the 200 day EMA which is closer to the 10,200 level. Either way, I think that this index may continue to be a problem, due to the fact that the major tech firms are dealing with Congress at the moment as well, so that of course causes a bit of headline risk.

Furthermore, stimulus is not coming until early next year, so Wall Street will probably continue to throw a tantrum based upon the idea of not getting cheap or free money, so keep in mind that this is a market that is going to continue to struggle going higher. At this point in time, I think that the election also weighs upon the market, so ultimately this is a market that is going to continue to see a lot of noise in general, and I think that this is a market that continues to be volatile, but if you are patient enough you will get an opportunity to buy some of these major companies at a discount. Keep in mind that all of the usual major tech companies will drive 40% of the volume of this market, so that continues to be why you cannot short it.