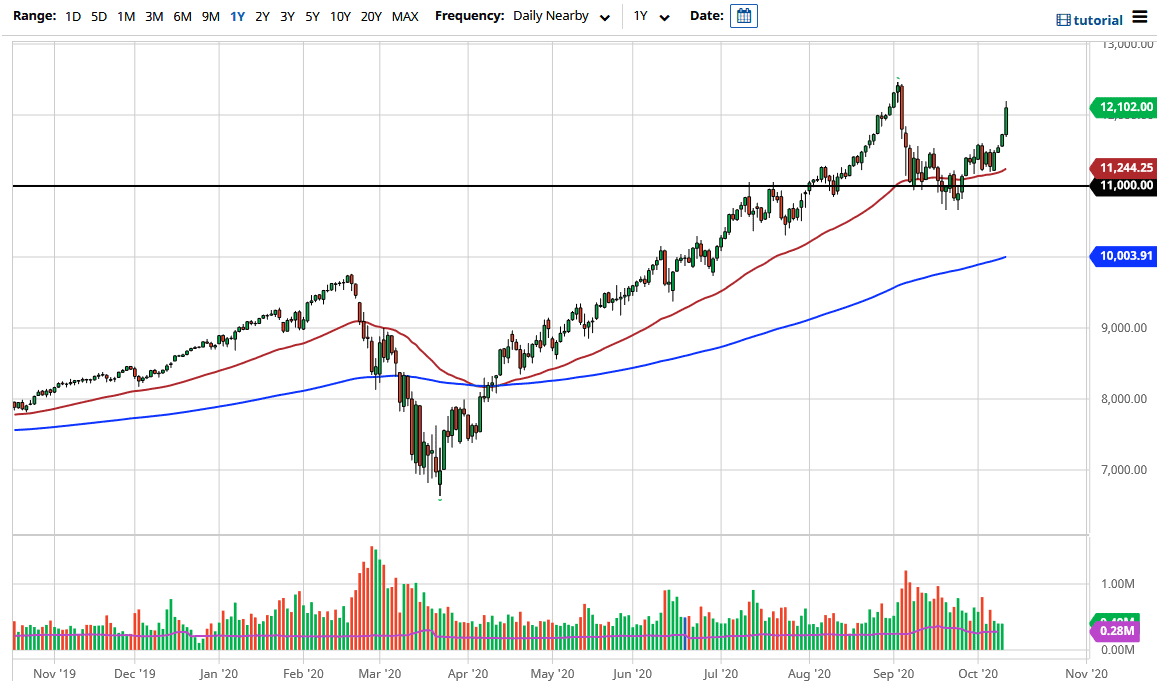

The NASDAQ 100 has exploded to the upside during the trading session on Monday, breaking above the 12,100 level by the end of the day. However, the market is getting a bit overdone, so I think what you need to do is wait for some type of short-term pullback in order to find value. At this point time, the market should have plenty of support underneath though, especially near the 11,500 level where we had broken out of what you could call an inverted head and shoulders.

The 50 day EMA sits at the 11,250 level. At this point, the 50 day EMA has been relatively stable for support, and therefore I think a lot of people will look at it as a potential opportunity to find buyers. Nonetheless, I do think that the market will reach the highs again, and then perhaps towards the 13,000 level. Ultimately, I think this moves based upon the US dollar, at least in a negative correlation. This is a market that I think is based upon the idea of stimulus, and of course the fact that “There Is No Alternative” as people on Wall Street would tell you.

I do like the idea of short-term pullbacks in order to find a bit of value, and I think that is the only thing that you can do, simply buy these pullbacks. As far as buying right away, I think you are taking a very serious risk as we could see a bit of a “blow off top” on the short-term charts, before breaking right back down to find more money. After all, “hot money” tends to leave rather quickly, and therefore if we start to see a lot of fear, they will jump out right away.

To the upside, I do think that we eventually go to the 13,000 level, but probably need to build up the necessary momentum and more importantly the confidence to go to the upside. In general, I think that this is a market that will probably continue to see some back and forth, but the longer-term trend is most certainly to the upside so you will notice that I did not mention anything about shorting, because quite frankly I just do not see the reason to do so, nor do I think that it would be easy to do so. If we break down significantly, it is simply a matter of waiting on the sidelines until you can buy at lower and cheaper price.