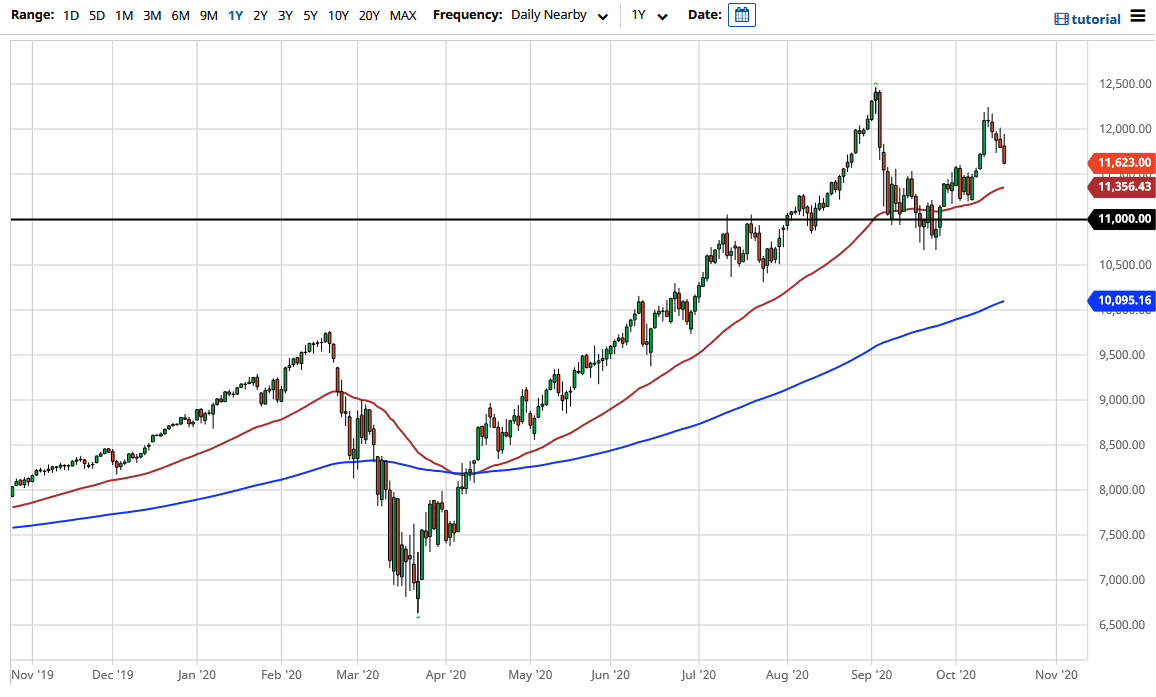

The NASDAQ 100 initially tried to rally during the trading session on Monday but found the 12,000 level to be far too resistant. Ultimately, we are closing towards the bottom of the candlestick and that suggests to me that we will have some follow-through. Because of this, I think it is very likely that we go looking towards 11,500 level. The 11,000 level underneath there will be significant support, which is a large, round, psychologically significant figure, and we have pulled back to that level only to bounce again.

The 50 day EMA sits just below the 11,500 level, suggesting that there are a certain amount of buyers in that general vicinity. At this point, people will start to look at this market as forming a bit of a “double top”, but I think it is a little early to call that. Beyond that, the market is very resilient in general, and therefore I do not have any interest in trying to go against the way it is built. It’s simply built to go higher, as all indexes do because they are products. They are sold as ETF markets that people wish to see go higher. Because of this, they are not equally weighted, and therefore you cannot simply think of them as trading 100 stocks, it is essentially trading six or seven.

This being said, they find a way to go higher over the longer term. Pay attention to the US dollar, because if it starts to gain strength, that will work against the value of stocks overall. Having said that, I do believe that the market is more than likely going to drop from here and find buyers underneath. Essentially, I am looking to “buy the dips” more than anything else. As I suggested in the S&P 500, I like the idea of buying the US dollar instead of shorting the market, because the two tend to move hand-in-hand and we get a little bit more control when it comes to the size your trade in the Forex markets. Essentially, the last 12 years have taught us that due to the Federal Reserve and to a lesser extent Donald Trump, shorting an index is a great way to lose money 95% of the time. With this, I am looking to buy this market somewhere around the 50 day EMA based upon a daily candlestick. In the short term, I think we continue to drift lower.