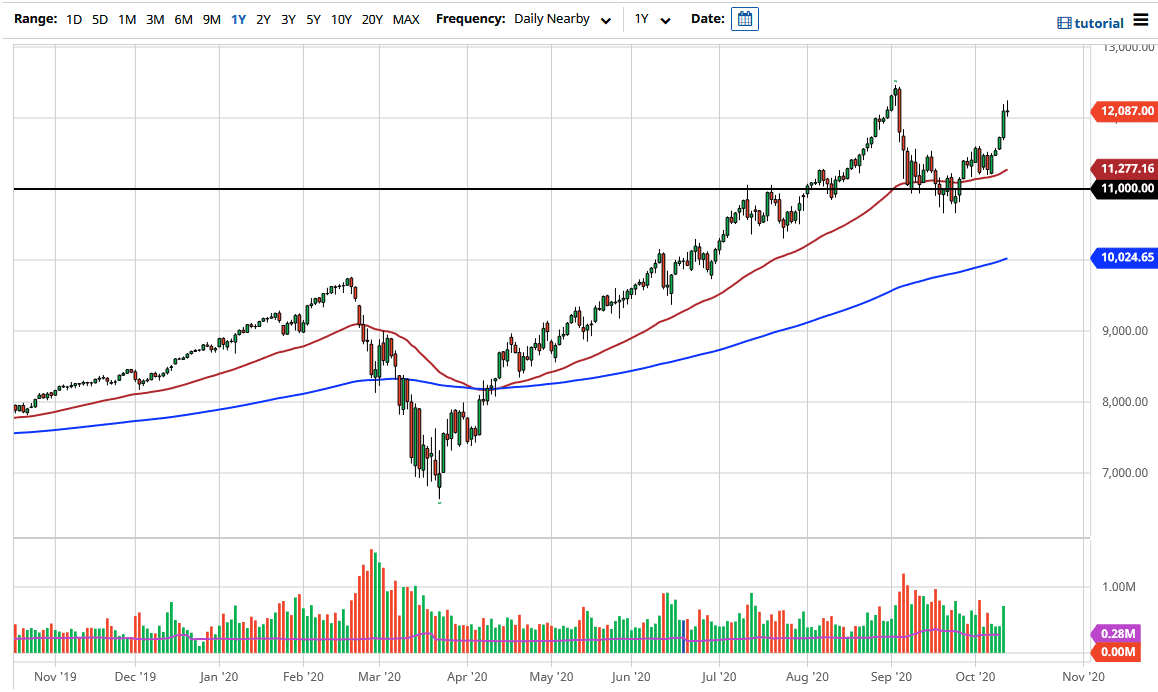

The NASDAQ 100 rallied a bit during the trading session on Tuesday but gave back the gains towards the end of the day as we have clearly gotten a bit overdone. At this point, a pullback would be the healthy thing to do and it looks like we might possibly get that opportunity. Forming a shooting star is a negative sign, so if we were to break down below that candlestick, it is likely that we could go down to the 11,550 level again, but obviously, the 12,000 level will have its say as well.

Looking at this chart, I think there are plenty of opportunities underneath for the market to turn around, and we are clearly still in an uptrend. There are going to be some people out there screaming that we are in the process of forming a “double top”, but I think the one thing that we have learned over the years is that no matter how dire and ugly things get, it is only a matter of time before somebody comes in to liquefy the markets and push stocks higher. Beyond that, the index is not equally weighted, so it is all of the favorite Wall Street stocks that decide where this goes in general.

Over the last 12 years, we have seen the Federal Reserve and various central banks around the world do whatever they can to keep equity prices up, which will end up in tears in the end. However, it has also shown that it is folly to try to short the markets for any significant amount of time. Yes, quick profits can be made by shorting, but at the end of the day, it is a lot less stressful to buy the market than anything else. Because of this, I will look for a supportive daily candlestick to start buying and be as patient as possible in the meantime as it could possibly take a couple of days. Breaking above the top of the candlestick for the trading session on Tuesday would be bullish, but it would also be more parabolic nonsense that you should avoid. The NASDAQ 100 has a bad habit of going parabolic occasionally, followed by spectacular pullbacks. Slow and steady wins the race, and that is especially true when you are talking about stock indices.