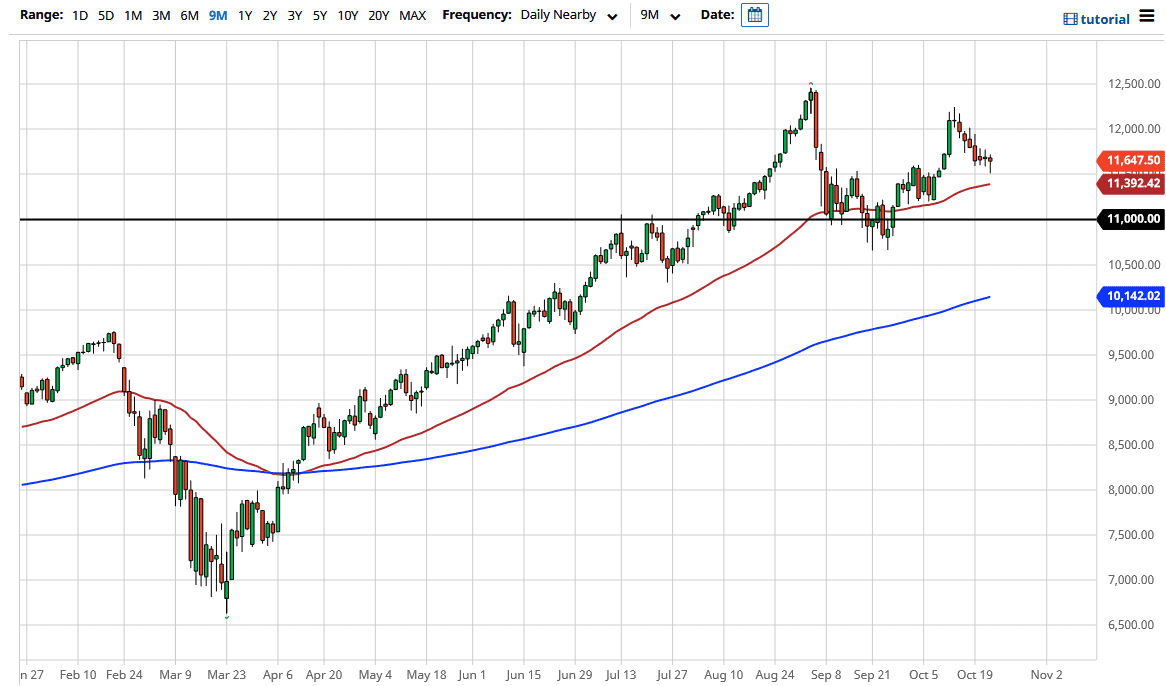

The market is testing the previous resistance, so it is a bit of a level that we should continue to respect. Underneath there, we also have the 50 day EMA which could continue to give reason for the market to go higher as well. With all of that being said, it is likely that we are going to continue to see the NASDAQ 100 rally going forward.

Remember that the NASDAQ 100 is essentially an ETF of roughly 7 or 8 stocks that everybody on Wall Street loves, including names such as Netflix, Alphabet, Facebook, Microsoft, just to name a few. In other words, you cannot sell this market, as it is designed to go higher over time. As long as Wall Street loves the same stocks they have for years, this is an index that will not fall very drastically for any significant amount of time. The great thing about this product, and it is a product, is the fact that if we suddenly see volumes start to flow to other companies, they will simply be re-weighted to have more influence on the index. While retail traders are not taught this, just a handful of the stocks make up roughly 44% of the weight of the index. In other words, you can literally have something like 10 or 12 stocks go higher and drag the index to the upside.

That being said, I see plenty of support not only at the 50 day EMA but also the 11,000 handle. This is a market that is in an uptrend, even though some people would scream “double top.” However, we have not confirmed that double top because we have not broken down to make a fresh, new low. That would be somewhere near the 10,650 handle, which of course we are nowhere near. The fact that we formed a bit of a hammer shows just how resilient this market is going to be and therefore it cannot be shorted here either. Even if we do break down, I will simply look for a buying opportunity at one of the other levels mentioned previously. To the upside, I anticipate that the $12,250 level would be a target eventually.