The NASDAQ 100 broke higher during the trading session on Thursday, slicing through the 11,500 level. By closing towards the top of the candlestick for the day, it does show that we have quite a bit of momentum here. With that being the case, I think short-term pullbacks will probably be bought into, as we could go looking towards the 12,000 level, possibly even the 12,500 level. However, we also have the Non-Farm Payroll numbers coming out during the trading session so that will more than likely throw a lot of noise in this market as well.

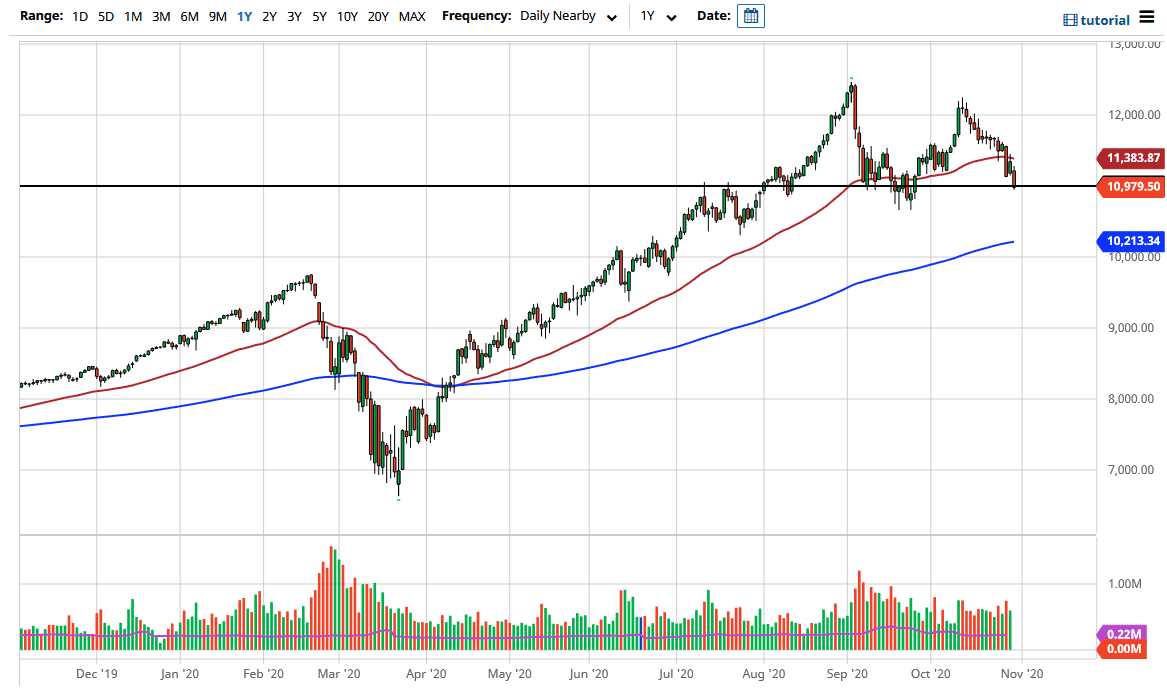

Underneath, we have the 50 day EMA near the 11,000 1140 level and curling higher. That is a good sign, and therefore I think that pullbacks will probably have plenty of buyers jumping in from a technical analysis standpoint. Furthermore, the 11,000 level should offer plenty of support. The reaction of the candlestick from last week that formed such a nice-looking hammer is a very good sign. Now that we are breaking out to the upside it is likely that we are ready to go to the upside.

I do believe that volatility is a major issue, so you cannot just jump in with a huge position right away. Ultimately, I think the dips offer value and that is how you have to look at this market. That being said, at 8:30 AM in New York, we will see a lot of volatility and I will be looking to take advantage of that volatility and perhaps even a bit of value if you are patient enough. Nonetheless, I have no interest in shorting this market anytime soon, because the NASDAQ 100 is made up of all of the household names that everybody on Wall Street is so enamored with. I like the idea of looking for some type of opportunity on shorter-term charts, perhaps even as short as the 15 minute timeframe. If you look at the last couple of weeks, you can also make an argument for a bit of a “rounding bottom” type of pattern, something that does suggest that we are starting to change the overall direction, and perhaps return to the longer-term trend. The 50 day EMA does tend to be important for this on the chart, and you can see it looks like it is working as well.