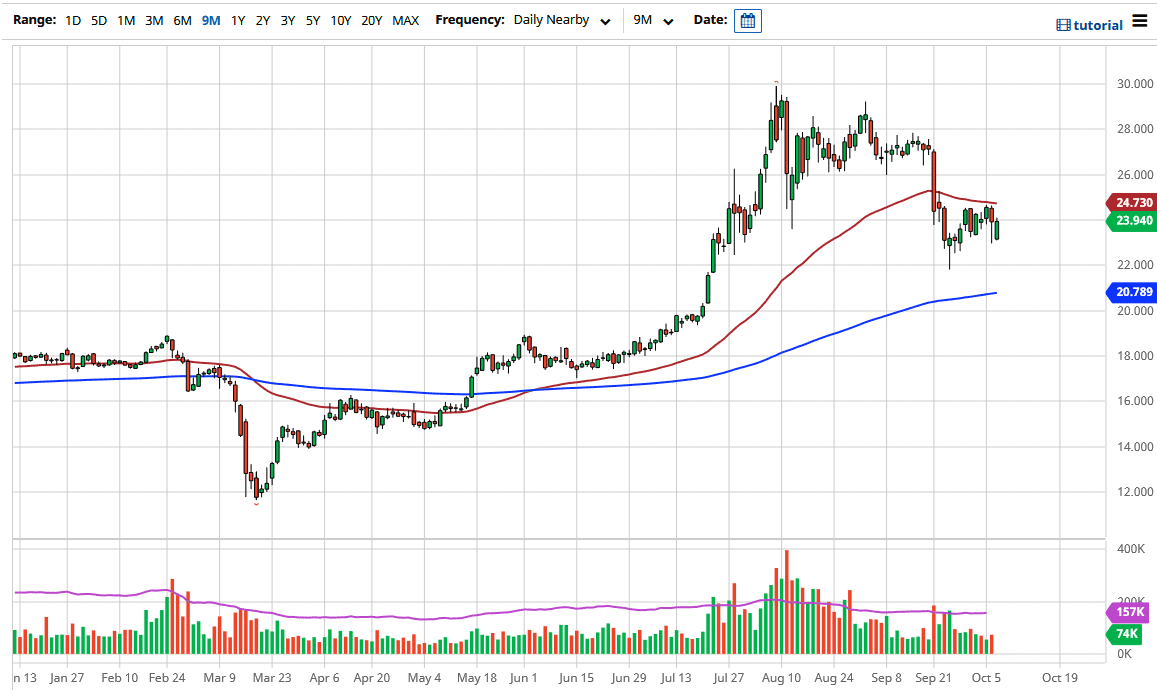

Silver markets initially gapped lower to kick off the trading session on Wednesday again, and then shot straight up in the air to reach the $24 level. At the end of the day, we essentially finish somewhat flat, which was a bit of a victory. If that is the case, then it makes quite a bit of sense that we would see this market stay in the same range that we have been in for a while. The $25 level, or the 50 day EMA if you will, offers a significant amount of resistance. To the downside, it looks as if the $23 level underneath has offered support. After that, the market has even more support at the $22 level. This is an area where the market has buyers in the past.

All that being said, I think that this will come down to what goes on with the US dollar and that will have a lot to do with what happens with most markets. Remember, silver is a bit more volatile than many other markets, so if we get some type of shock, we could see silver really fall apart or take off to the upside. Looking at this chart, I think that we are more likely than not to bounce around between the 50 day EMA and the $23 level, until at least we get some type of significant move.

The market closed towards the top of the candlestick, so that suggests that there is probably more bullish pressure than bearish, but at the end of the day I think if you are trying to play the “anti-US dollar” trade, you are better off doing it in the gold market which by the way has not shown anywhere near the bullish pressure. That being said, this is a market that I think you need to pay quite a bit of attention to, and I would say for a longer-term trade, you are looking for a buying opportunity closer to the $20 level for more of a “buy-and-hold” type of trade. If we were to break down below there, then the entire thesis of silver going higher would come undone. That would almost certainly be in reaction to an extremely strong US dollar. Right now, that does not look likely to be the case, so I think more back-and-forth is what we are looking at.